Check 21

An introductory guide explaining Check 21, how it functions, and key concepts for operating a check integration.

Check 21 is the Federal Reserve’s electronic check clearing service. It’s an asynchronous network where batches of check images are sent to the Federal Reserve, sorted, and transmitted onwards to payers’ depository institutions. Check 21 settles within the financial institutions’ Federal Reserve accounts.

How Check 21 works

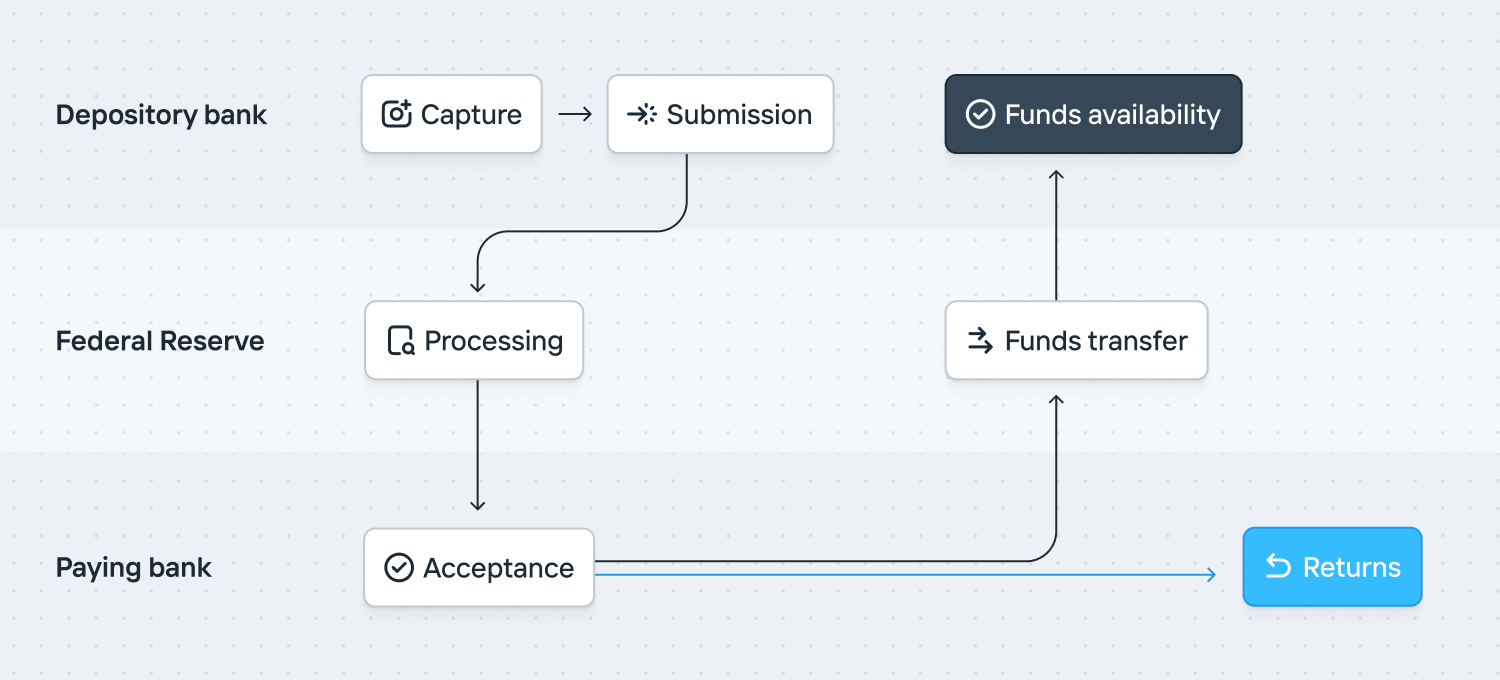

Check 21 submissions require images of the front and back of the check. Details like the amount, routing number, and account number are parsed and included in the submissions. Although much of the parsing can be automated, check processing is labor intensive. Here’s how it works:

Check capture: When a check is deposited at a bank, the bank captures an electronic image of the front and back of the check along with the Magnetic Ink Character Recognition (MICR) line data. The physical check is truncated (i.e., not sent to the paying bank). Instead, the electronic image and associated data are used for processing.

Submission: The bank creates an Image Cash Letter (ICL), which includes the electronic check images and associated data. The ICL is formatted according to the X9.37 or X9.100-187 standards. The ICL is transmitted over a secure network to the Federal Reserve for further processing.

Federal Reserve processing: The Federal Reserve receives the ICL and validates it for compliance with Check 21 standards. This includes checking for image quality, completeness, and correctness of the MICR line data. The Federal Reserve routes the electronic check image to the paying bank (the bank on which the check is drawn) using the check’s routing number.

Acceptance: The paying bank receives the check image and verifies it for accuracy, ensuring that the paying account is open and that there is a sufficient balance. If the check is accepted, the bank posts the transaction to the account holder’s account, debiting the amount specified on the check.

Funds transfer: Upon validation, the paying bank notifies the Federal Reserve indicating the acceptance of the check. The Federal Reserve acknowledges the receipt of the notification and then facilitates the financial settlement between the banks involved. This typically occurs through the Federal Reserve’s FedACH or Fedwire services.

Funds availability: The depositary bank’s own funds availability policy will determine when the funds are available to the account holder.

Returns and adjustments: If a payer’s financial institution declines to accept a check (for example, insufficient funds or the account being closed), they can return it through Check 21. The paying bank creates a return ICL and sends it back to the depository bank through the Federal Reserve. Any discrepancies or issues identified during processing are handled through adjustments, which are processed similarly to the original transactions.

Disputes

Explicitly, Check 21 doesn’t intermediate disputes. This is different to the card networks.

Substitute checks

In the event a paper check is needed, the Federal law allows the creation and use of substitute checks. Substitute checks are used when the clearing or receiving bank either cannot process electronic images, or prefers a paper document. Occasionally, paper checks are used as a proof of payment or for legal or record keeping purposes. In these situations, the customer can request a substitute check to be provided.

Alternatives

As an alternative to Check 21, ACH supports converting checks to ACH transfers. These check conversions are limited to checks under USD 25k and can’t be used for checks with auxiliary on-us data (which is typically a check number).

Schedule

The Federal Reserve’s Check 21 schedule is here:

https://www.frbservices.org/financial-services/check/check21.html

Technical implementation

Check 21 uses a public format. The specifications are available from the Federal Reserve Bank

The format mixes EBCDIC and in-lined TIFF images.

Operating a Check 21 integration

Check 21 doesn’t have a positive feedback mechanism. You don’t know if a check has been accepted by the payer’s bank. You solely know if you haven’t received a return yet.

There are specialized check scanners which scan the front and back of checks and parse the Magnetic Ink Character Recognition (MICR) values. These can be useful if you’re accepting physical checks at scale.

Check 21 also supports Remote Deposit Capture (RDC). This allows account holders to submit images of checks.

While most returns are received through the regular return item channel, you’ll also want to watch for adjustments. They’re far more manual.