Overview of Real-Time Payments

An introductory guide explaining Real-Time Payments, how they function, and key concepts for operating an RTP integration.

Real-Time Payments is a USD only instant payment service developed by The Clearing House. It reaches roughly 71% of US depository accounts.

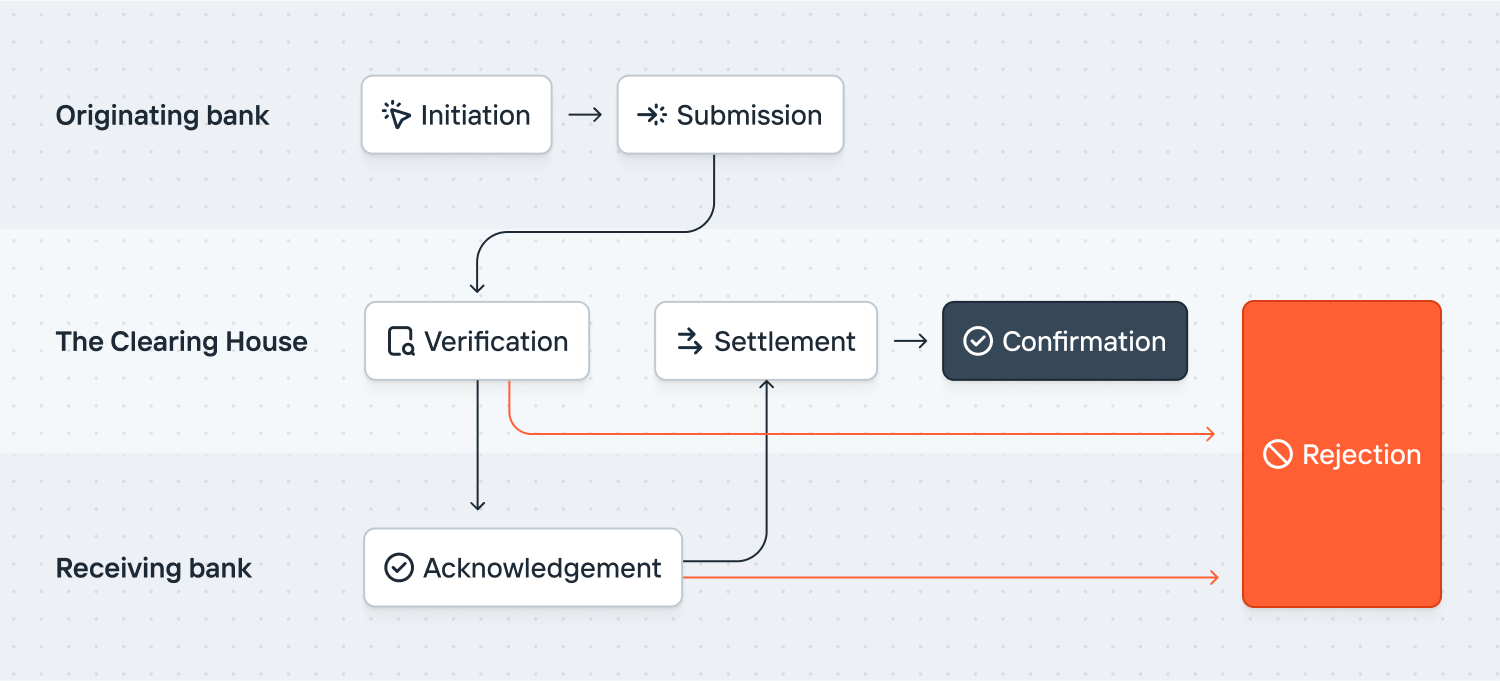

How Real-Time Payments work

Each participating financial institution maintains a balance in a shared New York Federal Reserve account to fund their account holders’ activity. This allows interbank settlement to happen immediately. Unlike wires, Real-Time Payments doesn’t have a culture of manual intervention. This leads to more immediate and deterministic operations. Like wires, Real-Time Payments are irrevocable. To understand how Real-Time Payments work, we can discuss it in a few stages.

Initiation: A sender creates a Real-Time Payment, which includes mandatory details like the recipient account number, routing number, amount, and remittance information. Unlike other types of transfers, Real-Time Payments also require that the sender provide their own account number.

Submission: The originating financial institution verifies the transfer details, ensuring the sender has sufficient funds to cover the transaction. Then the transfer details are submitted to The Clearing House for review. Unlike ACH, these transfers are not batched and are submitted on a transaction-by-transaction basis.

Verification: The Clearing House verifies that the transfer details are correct and then forwards the information to the receiving financial institution. If they are unable to complete the transfer, it is rejected and the originating financial institution receives a notification of the failed transfer.

Acknowledgement: The receiving financial institution confirms they have received the message and accepts the transfer. The receiving institution can also reject the transfer for a variety of reasons.

Settlement: Following acknowledgement, The Clearing House immediately moves funds between the originating and receiving financial institutions’ accounts.

Confirmation: After the transfer is processed, both the sender and the receiver receive immediate notifications about the transaction. This entire process happens within a matter of seconds.

Rejections, not reversals

Real-Time Payments transfers can fail. Common reasons are that the receiving account number details aren’t valid or the account has been closed. Once they succeed, Real-Time Payments cannot be reversed or returned.

Request for Payment

Real-Time Payments supports a “Request for Payment” mechanism. This feature allows beneficiaries to request funds from another party. The user experience varies by institution.

Availability

The network is always available, excepting scheduled downtime for maintenance. Transactions are confirmed by receiving institutions in real-time.

Support

Real-Time Payments works well but because support isn’t as widespread as ACH you need a fallback. You can see if a routing number supports Real-Time Payments using our Routing Number endpoint.

Message format

Real-Time Payments use the ISO 20022 messaging format, which defines a wide ontology of financial services metadata. The FedNow service uses the same format.

Limits

Real-Time Payments are subject to limits by The Clearing House. As of February 2025, the per-transaction limit is $10,000,000.

Zelle and related networks

Zelle is a digital payments network with a similar profile. Zelle payments can be settled over the Real-Time Payments network, but they are not interoperable.