Overview of FedACH

An introductory guide explaining ACH, how it functions, and key concepts for operating an ACH integration.

Automated Clearing House (ACH) is the dominant low-value transfer mechanism in the US. ACH typically refers to the Federal Reserve’s FedACH network which implements the rules maintained by Nacha (formerly stylized as the National Automated Clearing House Association, NACHA). Electronic Payment Network (EPN) is an alternative ACH network operated by The Clearing House (TCH).

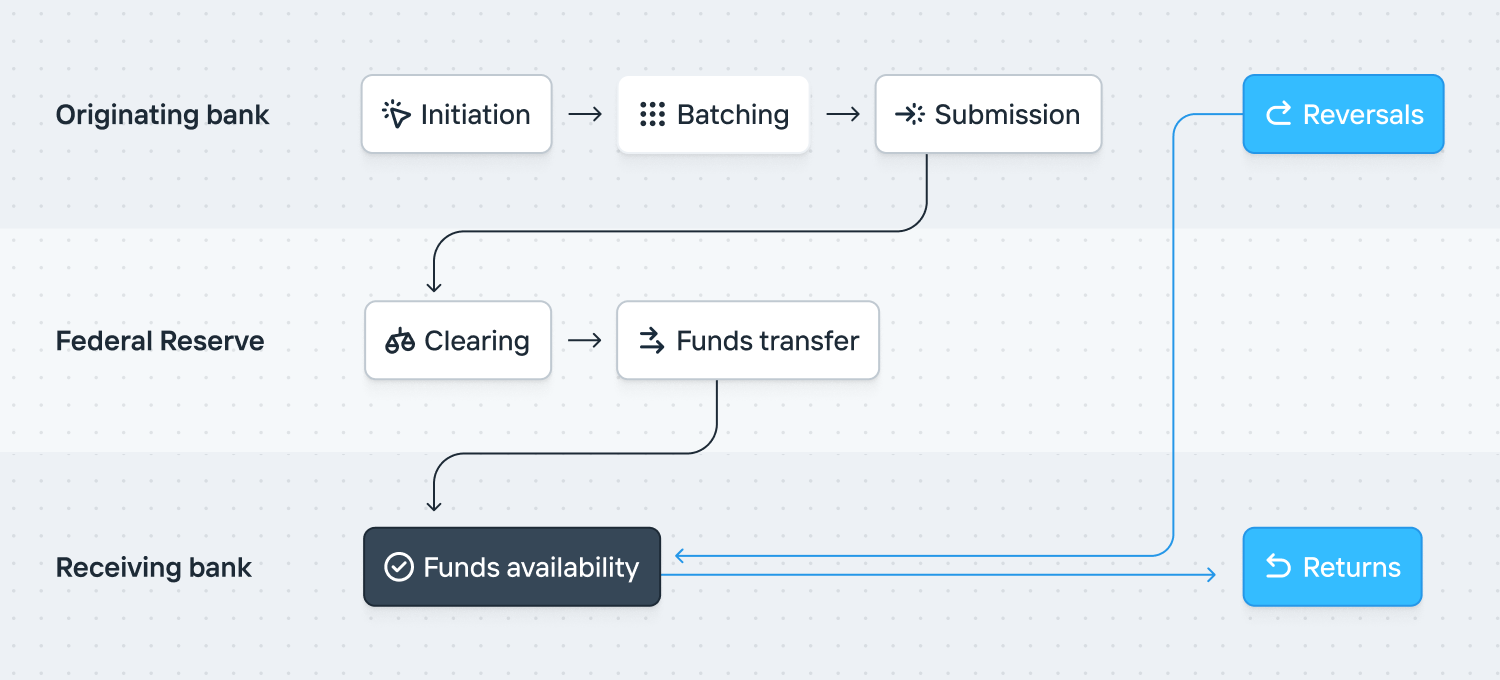

How FedACH works

FedACH is an asynchronous network that sends files containing batches of transfers from the originating depository financial institutions (ODFI) to the Federal Reserve, and ultimately onward to the receiving depository financial institutions (RDFI). To understand how ACH works, we can discuss it in a few stages.

Initiation: An ACH transfer is created, which includes mandatory details of the destination account number, routing number, amount, and Standard Entry Class (SEC) code. There are optional parameters of the recipient’s name and identifying number. Explicitly, most financial institutions don’t enforce that the recipient name on the transfer match the account holder name.

Batching: Unlike other payment methods, ACH transactions are batched and do not settle instantly. The originating depository financial institution (ODFI) consolidates all ACH transfers into a smaller set Nacha files for submission. A company operating at scale can sometimes request their transfers be batched into their own file.

Submission: The Nacha files are submitted to the Federal Reserve at specified times each day. As is expected, these align with specific submission windows and affect when funds are available at the receiving depository financial institutions (RDFI). If a file is successfully submitted, the Federal Reserve will respond with an acknowledgment. Increase publishes the submission status of every ACH file. Additionally, ACH transfers can be submitted with different settlement timing (Same day or Standard). You can read more about settlement timing below.

Clearing: During a submission window, the Federal Reserve aggregates all transactions from various financial institutions, nets them out, and calculates the final amount owed by and to each participating financial institution.

Funds transfer: After clearing, the actual transfer of funds occurs during the settlement process. The Federal Reserve ensures that the appropriate amounts are debited and credited to the respective financial institution.

Funds availability: Even though the processing might happen on the same day (for Same Day ACH) or the next day (for Standard ACH), the funds might not be immediately available. This delay is often due to the financial institution’s policies on funds availability and the time needed for risk management and fraud prevention. A common example of this are debit funds holds.

Returns: An ACH transfer can be automatically returned by the receiving depository financial institution (RDFI) within 2 business days for non-consumer accounts, and 60 days for consumer accounts. A late return can be requested after these deadlines, but the originating depository financial institution (ODFI) can accept or reject them at their discretion. Learn more about ACH Returns.

Reversals: The originating depository financial institution (ODFI) can attempt to reclaim funds from an erroneous transfer by sending a second ACH Reversal. Learn more about ACH Reversals.

ACH directions

ACH supports both credit and debit origination. Credits allow you to push funds to a recipient. Debits allow you to pull funds from a recipient.

| You originate | You receive | |

|---|---|---|

| Credit | Funds are removed from your Account (-) | Funds are added to your Account (+) |

| Debit | Funds are added to your Account (+) | Funds are removed from your Account (-) |

ACH credits, also known as a direct deposit, are commonly used for payroll, tax refunds, and pension payments. Sending an ACH credit is relatively simple since funds are pushed from a bank account you own. Funds availability is typically 1-2 days.

ACH debits are commonly used for bill payments, such as utility bills, mortgages, loans, and subscription services, where the originator pulls funds from the recipient’s account. However, since debits move funds not owned by the originator, they require authorization from the recipient and are accountable to funds holds. To learn more, view our tutorial on how to set up ACH debits.

When sending an ACH debit or credit, you must specify the Standard Entry Class (SEC) code, which is used to classify the ACH transfer by the type of recipient account and intended use.

Non-financial messages

ACH supports some non-financial messages. One is the confirmation note, also known as a Prenote, which is used for accounting and routing number validation. Another is a Notification of Change. Notifications of Change are optionally sent by receiving depository financial institutions (RDFI) to communicate that although a transfer has been accepted, in the future, updated details should be used.

Timing

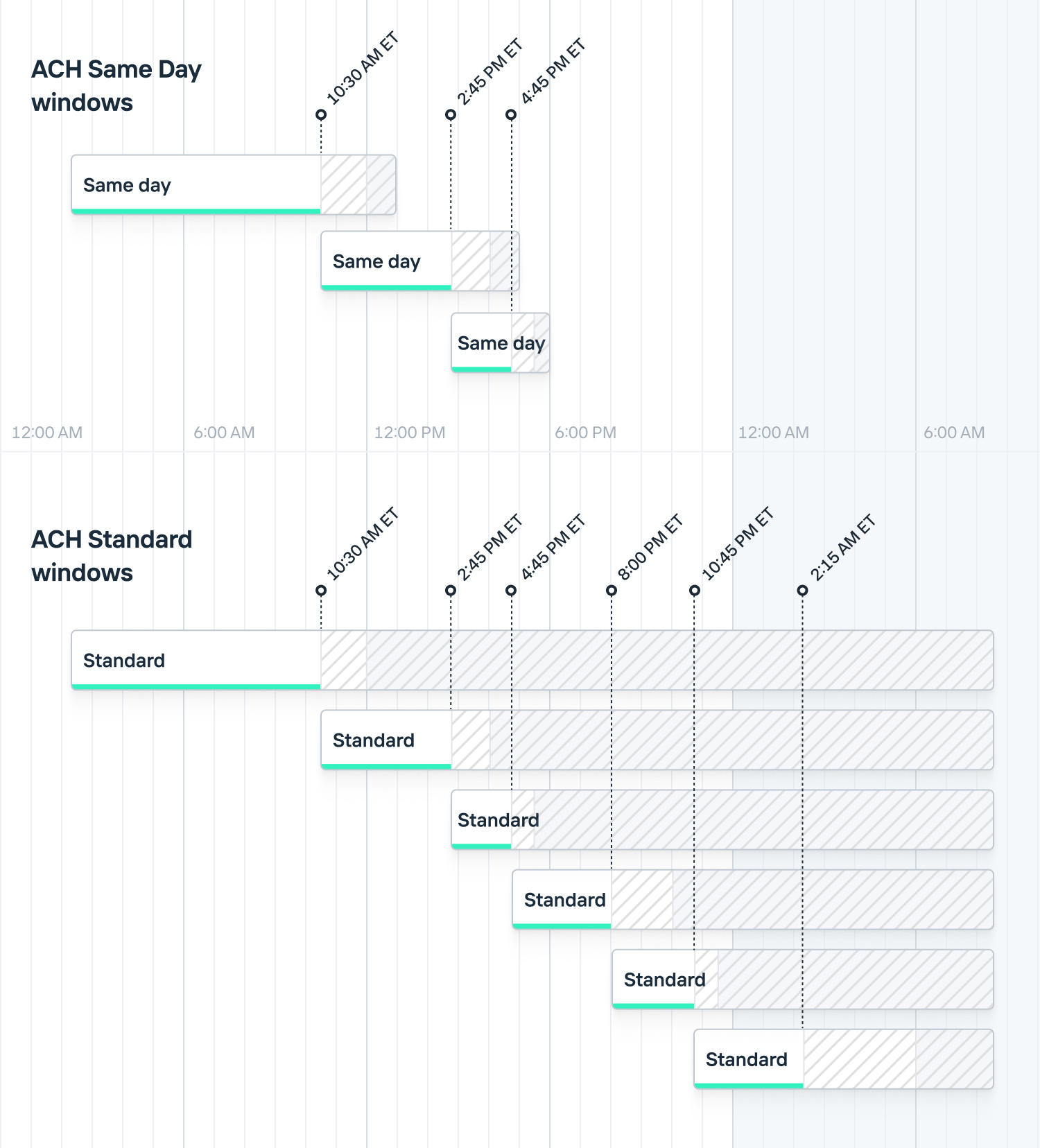

FedACH operates three same-day windows and six future-dated windows. Increase submits transfers in every window. You can track Increase’s ACH submission status at any time.

Each FedACH window is made up of three parts:

- The Transmission Deadline is the cutoff. FedACH must receive files before this moment.

- The Target Distribution is when FedACH aims to tell receiving depository institutions about the transfers. FedACH may occasionally miss this deadline.

- The Settlement Schedule is when FedACH will fund the financial institutions’ Federal Reserve accounts.

Increase submits throughout the day and makes a best effort to submit your ACH transfers to the next available window. To guarantee delivery to FedACH for a specific window, submit your transfers 1 hour before the FedACH window. Increase will still process most transfers submitted less than 60 minutes before a FedACH cutoff before that deadline.

Validating an account

To validate account details you have two options:

- Use a service like Plaid or Finicity, where an account holder provides their bank login details and the platform ~synchronously scrapes the bank’s website.

- Send the account holder micro-deposits and have them confirm the amounts.

There are older methods like collecting an image of a voided check or using confirmation notes but they’re less used in modern integrations.

Technical implementation

Nacha’s message format is a fixed-width flat file containing batches of transfer entries. Nacha’s specification is here:

https://achdevguide.nacha.org/ach-file-overview

Many financial institutions implement ACH by allowing clients to submit Nacha’s file format through SFTP servers. Submission to the Federal Reserve runs similarly but uses an IBM product, Connect:Direct. FedACH responds with a custom-formatted acknowledgement file within 15 minutes. (There are escalation channels if a file hasn’t been acknowledged in that timeframe.) Most financial institutions similarly operate an acknowledgement mechanism.

Operating an ACH integration

A common frustration with ACH is that there’s no transfer receipt notification method. As a transfer originator, you have no way to definitely know if or when a transfer has arrived to a recipient’s account.

Some depository institutions allow account holders to maintain an allowlist of companies that can debit their account. This is done by referencing the Company ID. In particular, if you’ll be debiting businesses, you’ll likely want them to register your Company ID with their financial institution.

ACH transfers have many structured parameters like the company_name, company_discretionary_data, individual_name, and individual_id. The specifics of how these are serialized to a transaction description shown to a recipient vary by bank.

Typical operational issues you’ll run into are that Nacha’s file form is ASCII. If you’re allowing UTF-8 data submission you’ll want to flatten it. You’ll also want to exclude client entered data containing things like newline characters.

Not all financial institutions preserve the trace numbers you submit. You’ll want to understand if yours does as it makes a difference to how you’ll correlate returns.

Many financial institutions will fund your ACH transactions by aggregating your daily files and batches possible by transfer effective date. Understanding your bank’s aggregation method is necessary for you to reconcile the transfer instructions you’ve submitted to the cash in your bank account.

While not common, there are data quality issues with FedACH. In particular, the network itself doesn’t store the state of a transfer. Therefore it’s possible for a receiving depository institution to return a transfer multiple times, for example. It’s also possible for them to include the incorrect details on a return.