Accounts and Account Numbers

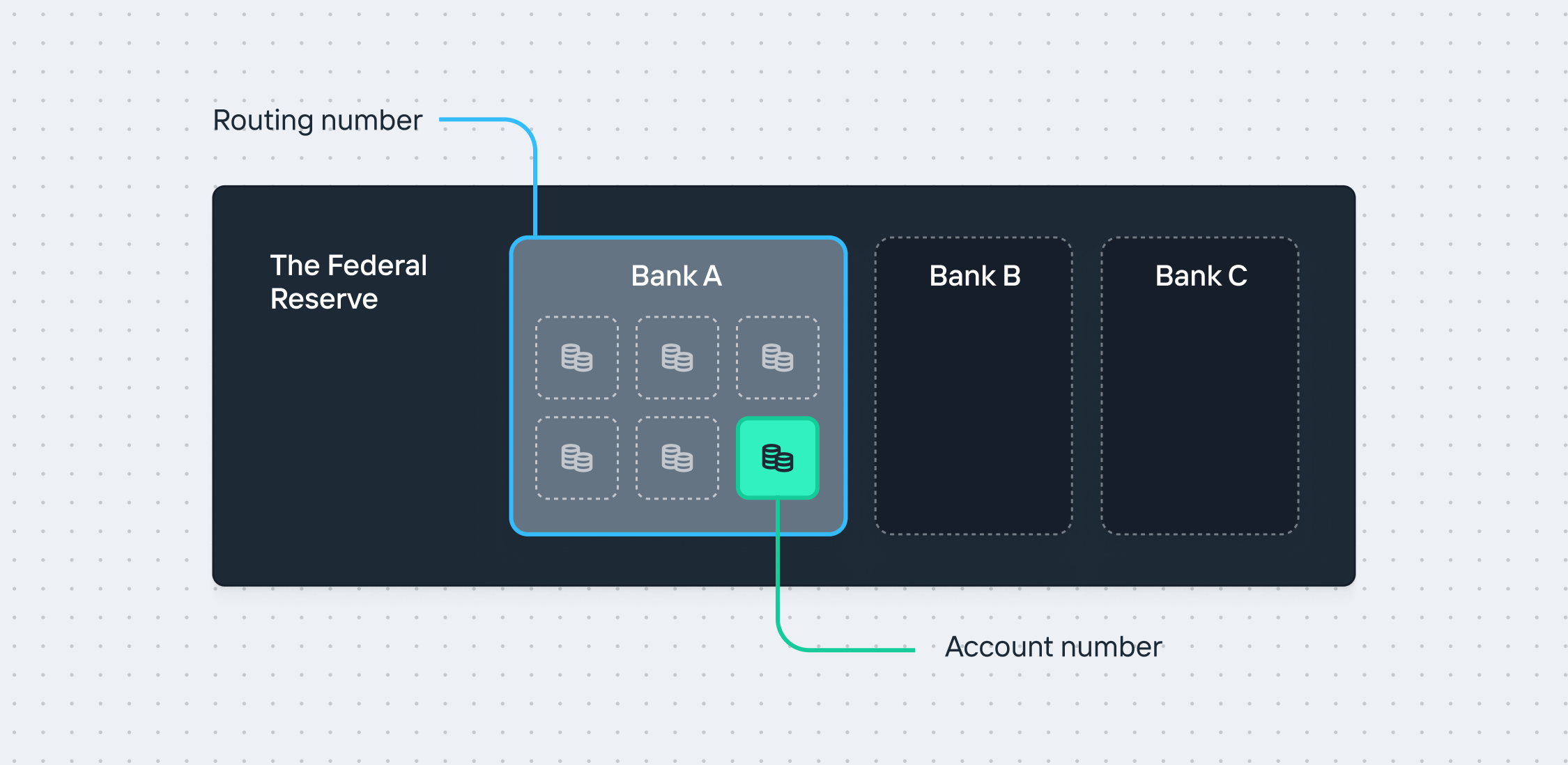

Banking cores serve as systems of record, meticulously tracking funds down to the penny in real-time. Bank accounts provide a convenient way to segregate funds by customer. Typically, core systems associate each account with a unique account and routing number pairing, which the customer uses to move funds in and out of the account. The account number serves as the customer’s identifier with the bank, while the routing number identifies the bank with the Federal Reserve.

A consequence of this one-to-one mapping of account and routing numbers is that reconciliation often needs to occur manually since all activity is associated with the same identifying information. Additionally, users have historically restricted access to their account credentials to protect against unexpected ACH debits.

Increase’s model

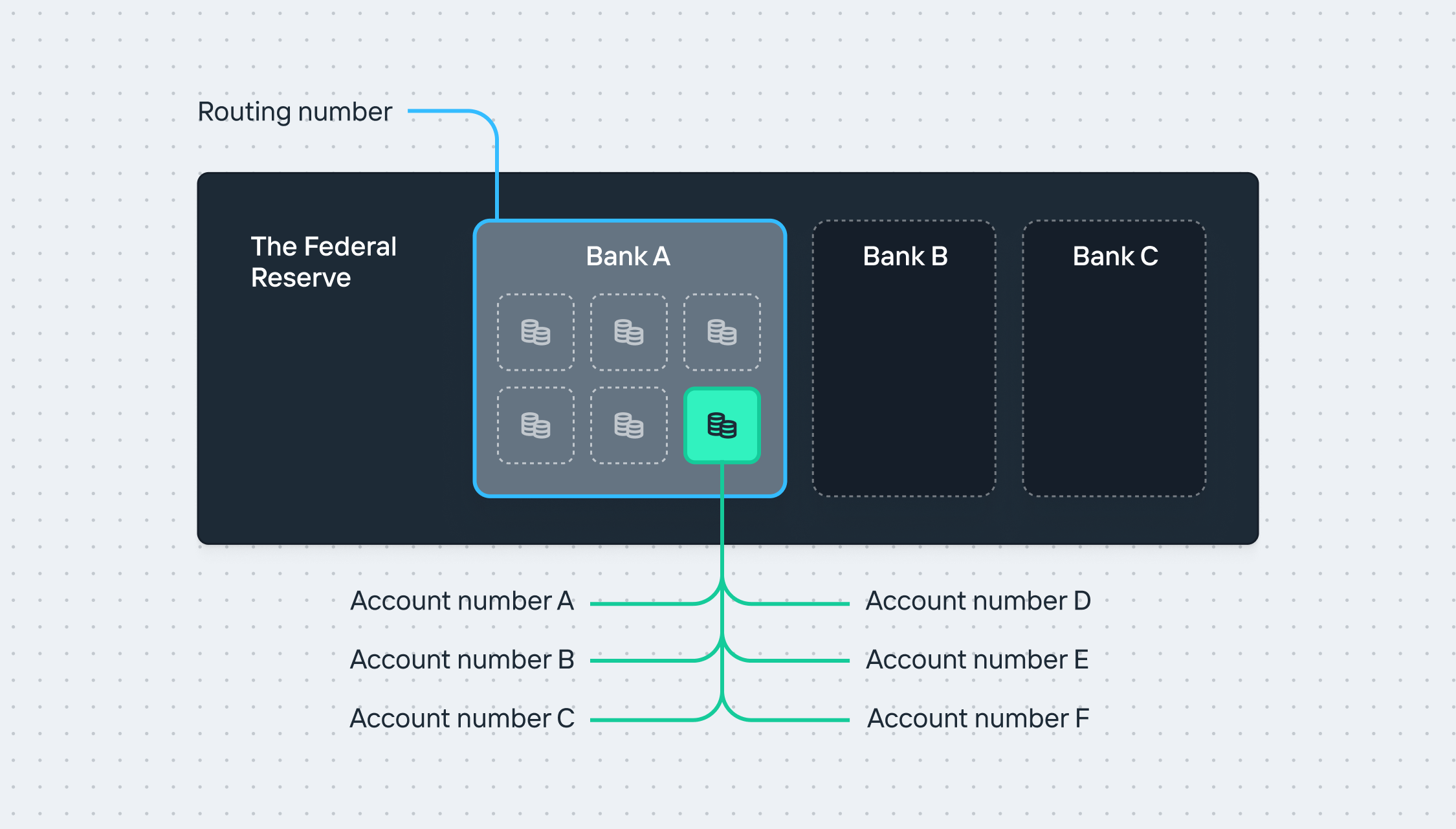

Increase’s core enables banks to separate the concept of an Account from an Account Number. Our account object represents a bucket of funds, while the account_number object acts as a pointer to that bucket of funds. This allows for a one-to-many mapping, providing much greater flexibility for new use cases. Importantly, these are building blocks for you to create and manage your own ledger or use Increase as your system of record.

Accounts

Accounts are your bank accounts with the bank partner. They store money, receive transfers, and can send payments. They may earn interest. Accounts may also have different legal structures, subject to bank approval. For example, they can be configured as typical demand deposit accounts (DDA) or as a custodial “for the benefit of” (FBO) accounts. You can programmatically create as many Accounts as you need. However, each Account must be associated with a valid Entity and a Program. This flexibility allows for better organization and supervision of funds.

Account Numbers

Account Numbers are unique identifiers that point to an Account. You can instantly create multiple Account Numbers for a single Account and manage them programmatically. This means you can generate unique Account Numbers for different transactions, departments, or projects, all pointing to a specific Account. You can also specify whether an Account Number can allow ACH debits. This flexibility provides more granular control of your funds, enhances tracking and reporting capabilities, and allows for fully programmatic reconciliation.

Examples

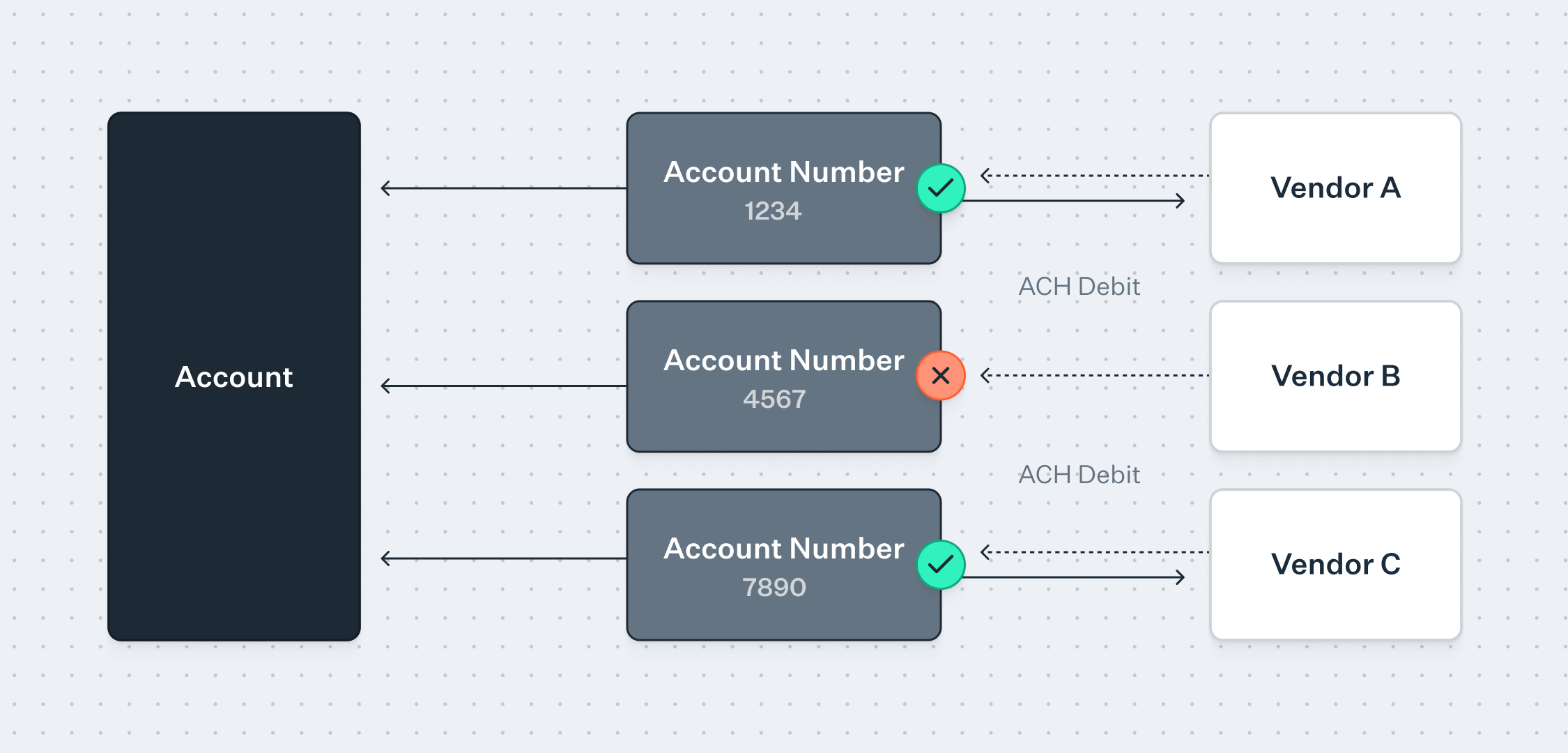

Tracking vendors

When setting up ACH debits to pay your bills (e.g., utility or rent bills), we recommend creating a unique Account Number for each vendor. This allows you to automatically associate each inbound transfer with that specific vendor, regardless of any missing descriptions or discretionary data, and enables you to disable debit access to your Account when needed.

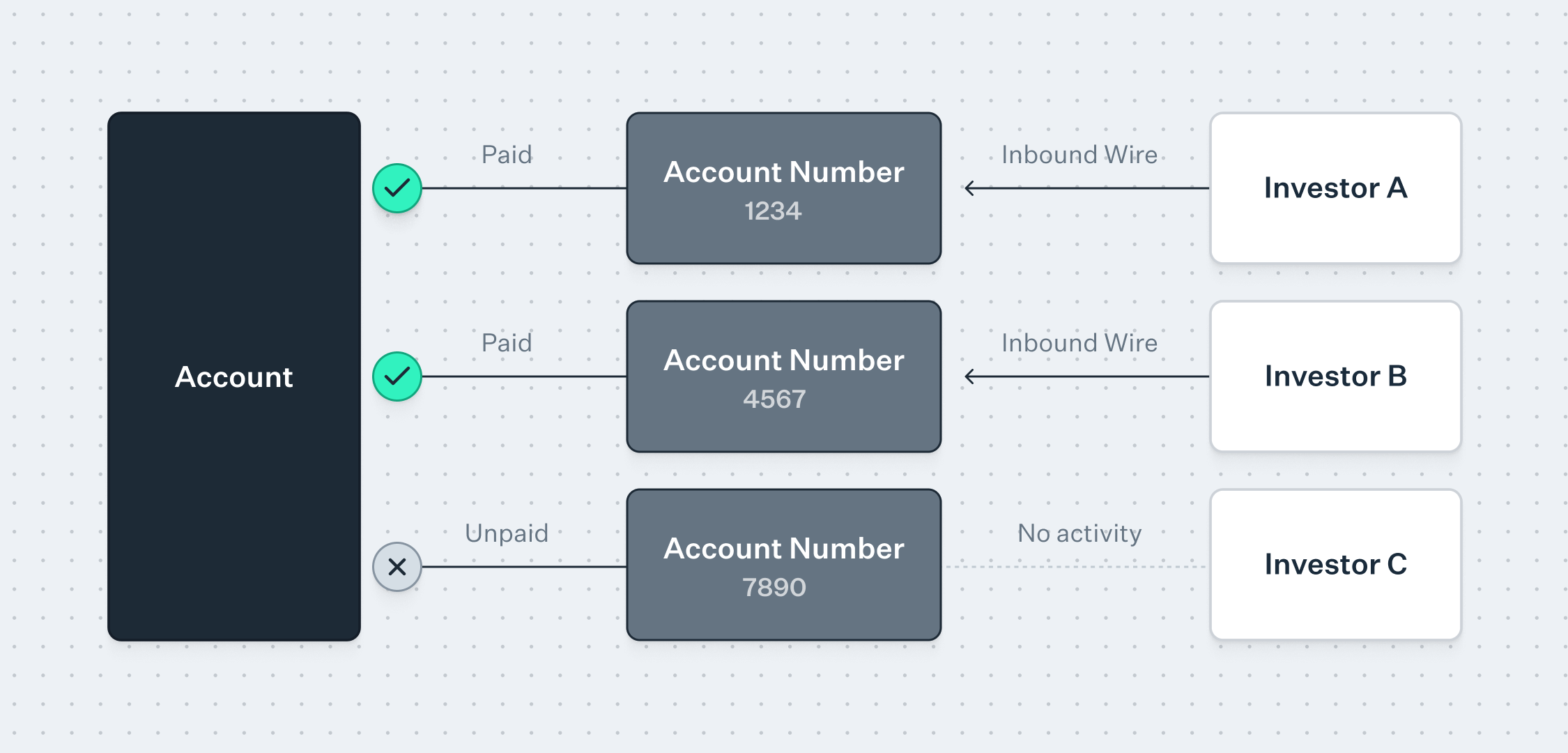

Capital calls

There are many use cases that require the reconciliation of received funds at scale. One example is managing capital calls for investments. Historically, investors have independently wired funds into a bank account, requiring manual reconciliation of each transaction to each investor.

With Increase, you can issue each investor a unique Account Number. This allows for automatic reconciliation of any received funds from that investor, regardless of how they send funds (via Wire, RTP, ACH, or even Check).