Sending an ACH debit transfer

ACH debits allow you to pull funds from a recipient and are commonly used for bill payments, such as utility bills, mortgages, loans, and subscription services. However, since debits move funds not owned by the originator, they require authorization from the recipient and are accountable to funds holds. For more information, view our guided tutorial on setting up ACH debits.

Sending an ACH debit with Increase

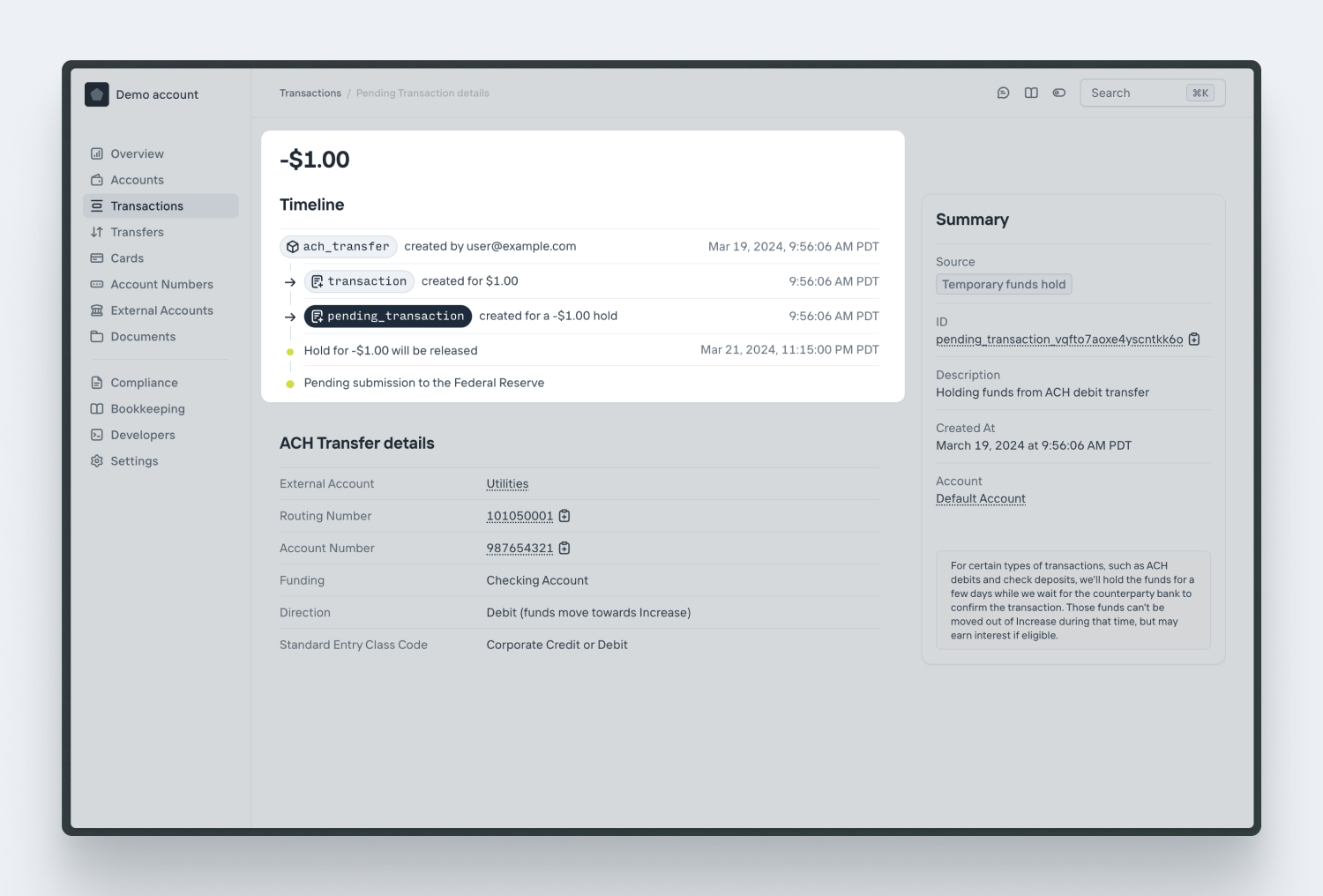

Originating an ACH debit via the Increase API kicks off several steps involving you, Increase, the Federal Reserve, and the receiving bank.

- You make a

POST /ach_transferscall with the details of how much you’d like to debit and data about the recipient. - A Transaction is immediately created for the full amount of the transfer.

- Simultaneously, Increase automatically creates a funds hold to help you avoid double-spending funds received by an ACH debit. The funds hold is released when the 2 business day return window has passed.

- When the file is submitted to the Federal Reserve, Increase updates the ACH Transfer object with its

submissiondetails. - When the Federal Reserve acknowledges the file (usually within fifteen minutes of file submission), Increase updates the ACH Transfer object with its

acknowledgementdetails. - The Federal Reserve forwards transfer details to the receiving bank several times per day. The predicted settlement time is in

submission.expected_funds_settlement_at. There may be delays and processing time required at the receiving bank, however. - If a Return is received from the receiving bank, the ACH Transfer object is automatically updated with

returndetails and a new Transaction is created to decrement funds.

Debit Authorizations

Before you originate an ACH debit, you need to collect an authorization from the person you’re debiting. The goal is to make sure funds aren’t being pulled out of a customer’s account without their consent. Depending on your use case and who you’re debiting you’ll need to meet different requirements when collecting your authorization.

If you’re debiting a business, the process is fairly straightforward. You need to obtain legally enforceable authorization. Most likely, this looks like including a clear description of the expected debits (both amounts and timing) in your terms of service. In the standard case, you’ll also set the Standard Entry Class (SEC) code to Corporate Credit or Debit (CCD).

If you’re debiting a consumer, the requirements are more nuanced. There are three types of authorizations for consumer debits: one time, recurring, and standing authorization.

The most straightforward is a one time debit which Nacha calls a Single Entry [0]. A Single Entry is exactly as it sounds: a one time debit for a specified amount.

The second is for Recurring Entries. These are always for the same amount (or within a communicated range of amounts) at a predictable time. This your rent payment for $2,500 on the first of every month. If you ever need to change the amount or the timing, you’ll need to give your customer 10 days notice [1].

If you’re planning to debit at variable times or for variable amounts, you’ll need a Standing Authorization but you’ll also need to ensure affirmative action for each Subsequent Entry. A Standing Authorization has to include specifics on which actions the consumer might take to trigger Subsequent Entries. For example, if you own an acupuncture practice, your patient might agree to be debited each time they come in for an appointment. The debit is triggered by an action on the consumers part.

Regardless of the type, all consumer authorizations must include:

-

Language regarding whether the authorization is for a Single Entry, Recurring Entries, or one or more Subsequent Entries initiated under the terms of a Standing Authorization;

-

The amount, or logic for how the amount will be determined;

-

The timing (including the start date), number, and/or frequency of the Entries;

-

The name or identity of the person being debited;

-

The account to be debited;

-

The date of the authorization; and

-

Language on how to revoke the authorization (including the time and manner in which the communication must occur).

The authorization must be obtained in writing [2]. The user needs to affirmatively agree to the authorization. A signature always works, but other generally acceptable forms of electronic consent can work as well. The definitive requirements are those laid out in the Electronic Signatures in Global and National Commerce Act. It hopefully goes without saying, but you should always rely on the advice of counsel when determining whether your consumer flow meets the requirements here.

In addition to holding on to the authorization yourself, you’ll also need to give a copy to the receiver.

Debit funds holds

Initiating an ACH debit via Increase adds money to an Increase account’s balance and decreases the balance of your counterparty at their financial institution. There is no positive acknowledgement for this type of transfer; the counterparty bank only sends an ACH Return message if they reject the transfer. Transfers can be rejected for many reasons, but most commonly: insufficient funds, incorrect account details, or a lack of authorization.

In general, most rejected transfers are returned by the end of the second business day after the ACH is sent. To prevent accidentally spending money that ultimately gets reversed, Increase places a hold on funds received via ACH debit.

Understanding the hold

The hold is visible in several ways in the Increase API and Dashboard. A Pending Transaction with a category of inbound_funds_hold and a negative amount offsetting the amount of the ACH debit is allocated to the account. The Inbound Funds Hold has a field automatically_resolves_at indicating when the hold will expire. You can query for ongoing or historical Inbound Funds Holds using the GET /pending_transactions endpoint. You can also receive a webhook Event when the Pending Transaction resolves.

An Account’s available balance is decreased by the sum of all the negative Pending Transactions. The Account’s current balance will include the value of the ACH Transfers that may still be returned and have Inbound Funds Holds against them.

Avoiding holds

If you’d like faster access to ACH debits, email us at support@increase.com to set up a reserve account that fits the transaction behavior of your business.

[0] Nacha Operating Rules Subsection 2.3.2.2 Debit Entries to Consumer Accounts

[1] Nacha Operating Rules Subsection 2.3.2.8 Notices of Variable Recurring Debit Entries to Consumer Accounts

[2] There are guidelines around oral authorizations but we don’t recommend these since they are hard to prove. Feel free to reach out to us if that’s something you’d like to discuss!