Programs

Your Increase team can organize its Accounts into groups called Programs. Each Program can have unique compliance or commercial terms.

Every team has a Program called “Commercial Banking” that you can use to hold your company’s own funds. If you are managing funds on behalf of your customers, Increase and your bank partner will work together to create additional Programs for you.

A Program controls much of the configuration for all of the Accounts belonging to it. Some of the things that a Program controls are:

- Account titling and structure

- Cashback paid on card payments

- Interchange earned on card payments

- Per-user dashboard access

- Required compliance reporting

- Reserve accounts and required thresholds

- Technology fees

- Transfer approval rules

- Visa Bank Identification Number (BIN) type

- Your bank partner’s interest or referral bonus rate

Some settings are configured by your bank partner, some by Increase, and some by you.

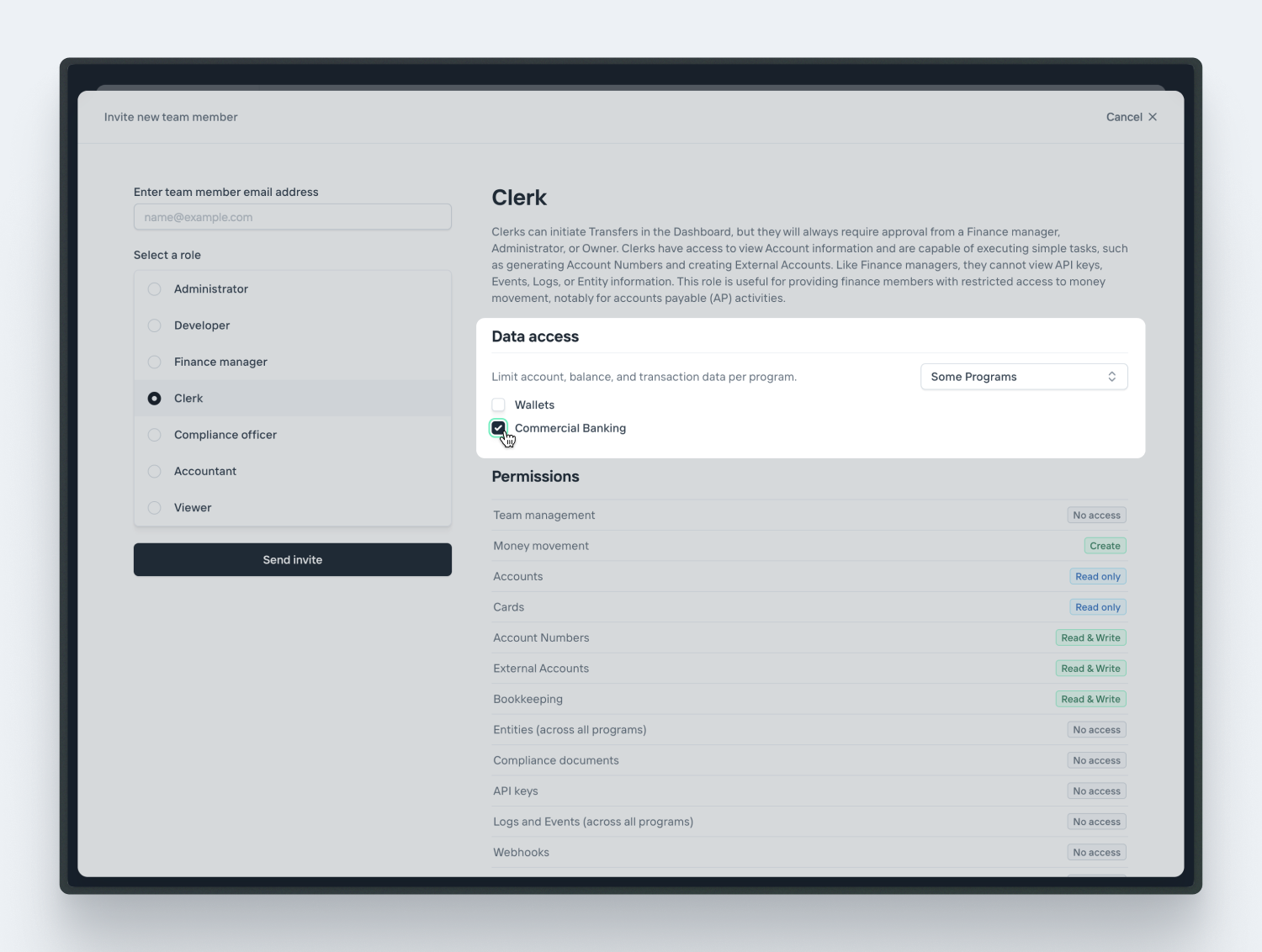

Limiting data access

You can limit the account and transaction data a team member can access in the Dashboard. Data permissions are scoped by Program—you can select all or a subset.

For example, this can be helpful if you have a team managing an FBO program, but don’t want to provide access to your commercial accounts. To modify a team member’s data access, visit the team page in the Dashboard settings.