Sending an ACH Transfer

ACH Transfers are the dominant low-value transfer mechanism in the US. Increase processes billions of dollars of ACH transfers each year using our ACH Transfer API.

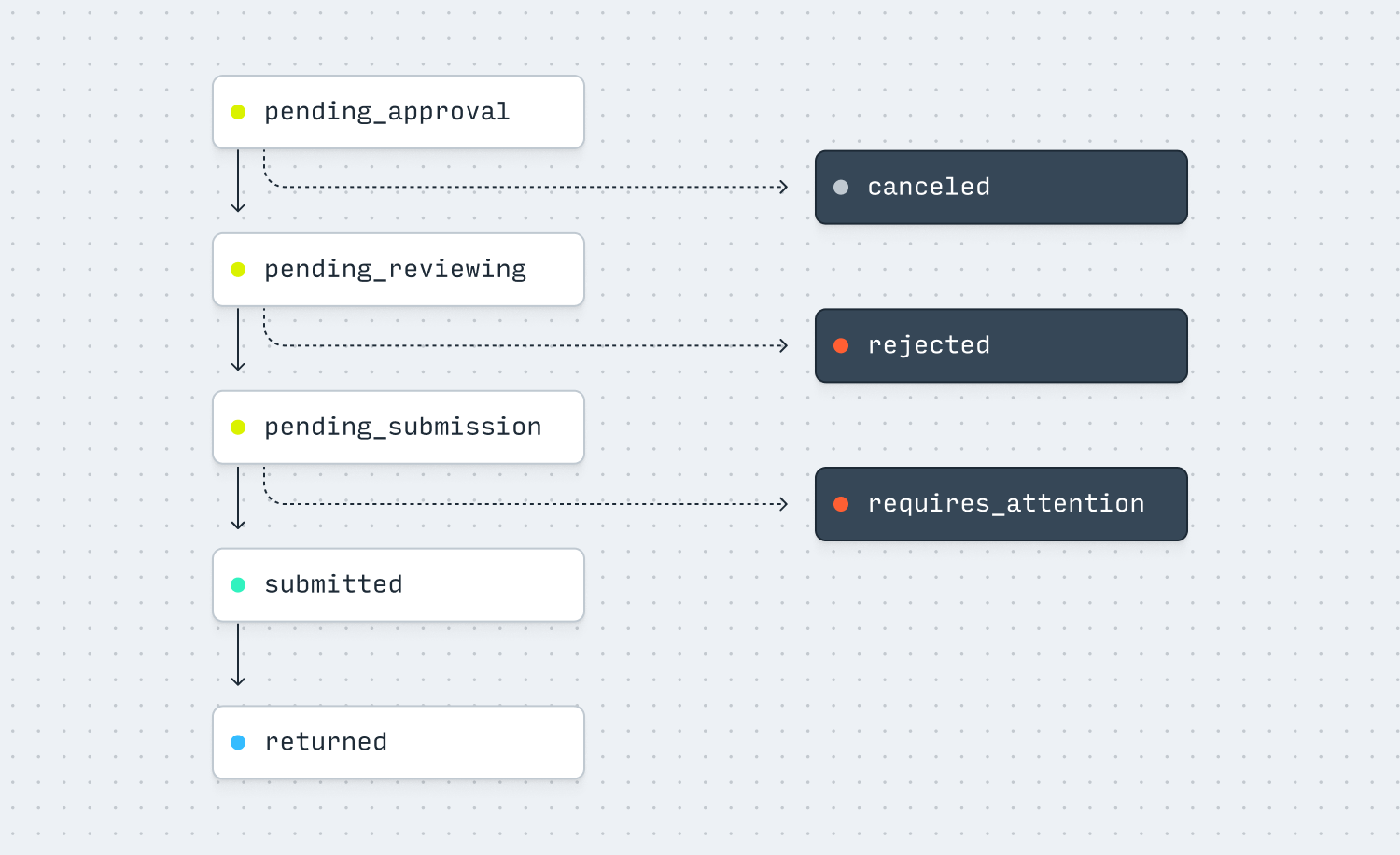

Lifecycle

| Status | Description |

|---|---|

pending_approval | The transfer requires approval from a member of your team. |

pending_reviewing | The transfer is pending review by Increase. |

pending_submission | The transfer is pending submission to the Federal Reserve. |

submitted | The transfer has been submitted to the Federal Reserve |

returned | The transfer has been returned by the receiver. There will be a second Transaction for the return. |

canceled | The transfer has been canceled. |

rejected | The transfer has been rejected by Increase. |

requires_attention | The transfer requires attention from an Increase operator. |

You can find additional details about sending an ACH Debit Transfer and receiving an ACH Transfer.

Sending an ACH credit with Increase

Originating an ACH credit via the Increase API kicks off several steps involving you, Increase, the Federal Reserve, and the receiving bank.

- You make a

POST /ach_transferscall with the details of how much you’d like to send and data about the recipient. - A Transaction is immediately created for the full amount of the transfer.

- When the file is submitted to the Federal Reserve, Increase updates the ACH Transfer object with its

submissiondetails. - When the Federal Reserve acknowledges the file (usually within fifteen minutes of file submission), Increase updates the ACH Transfer object with its

acknowledgementdetails. - The Federal Reserve forwards the transfer details to the receiving bank several times per day. The predicted settlement time is in

submission.expected_funds_settlement_at. There may be delays and processing time required at the receiving bank, however.

ACH transfers work based on a principle of assumed success. There’s no positive acknowledgement from a receiving bank confirming that they’ve received and allocated the transfer to one of their customer’s accounts.

Approvals

For transfers that require approval from another team member, the ACH Transfer is created with a status of pending_approval and a Pending Transaction is created to hold funds.

If the transfer is approved, the ACH Transfer object updates with its approval details and the status is changed to pending_reviewing. Once the transfer is submitted, the Pending Transaction status updates to complete and a new Transaction is created to remove funds from your Account. After this point, the transfer cannot be canceled.

If the transfer is not approved, the ACH Transfer object updates with its cancellation details and the status is changed to canceled. The Pending Transaction status updates to complete but no additional Transaction is created.

Reviews and rejections

Occasionally an ACH Transfer will need to be manually reviewed by an Increase operator. When this occurs the ACH Transfer object status will be set to pending_reviewing.

Once reviewed, the status changes to pending_submission and things progress normally. However, rarely an ACH Transfer may be rejected by Increase. When this occurs the ACH Transfer object status updates to rejected and no Transaction is created on your Account.