Customer stories

How CapitalOS built their spend management platform on Increase

CapitalOS offers embedded spend management solutions for B2B platforms looking to launch card-based products for their users. As B2B platforms increasingly become the operating system for small businesses, they’re uniquely positioned to save time and money for their users through smart spend management. With CapitalOS, these platforms can solve this pain point for their users with a single API call—including embeddable UIs, customized cards, underwriting, risk, and capital. In doing so, CapitalOS enables platforms to establish a new revenue stream, increase user retention, and unlock access to business spending data.

The problem

When CapitalOS set out to build their embedded spend management solution, they quickly ran into challenges finding partners that could support both their regulatory and technical requirements. “We found it difficult to manage multiple layers between infrastructure providers and the end user.” said Matan Goldschmiedt, CapitalOS’s co-founder and CTO.

Initially, CapitalOS began searching for two separate infrastructure partners: an issuer processor to facilitate card issuance, and a banking provider to facilitate payments from users. “We talked with many BaaS and card issuer processors, but we just didn’t fit into their pre-existing models,” Matan said. “They wanted to place requirements on our users that didn’t seem relevant.” Partnering with a separate banking provider also meant increased costs and delays in crediting payments. “We either needed to absorb wire fees or accept the credit risk related to delayed ACH payments,” said Matan. All of these factors ultimately increased the complexity of their systems and the cost of capital.

Existing solutions also lacked the customization and transparency that CapitalOS needed. An important part of building an embedded charge card program is being able to provide powerful controls for end users, but this requires granular access to the underlying network data. “It was really important for us to be in the authorization flow, but few providers offered this,” said Matan. This left the team with the difficult tradeoff of either expending significant resources building a direct integration with Visa, or accepting less visibility into their system. “Higher visibility helps lower fraud risk and strengthen differentiation, which ultimately creates a better and more cost effective experience for the businesses we serve.”

Initially, CapitalOS began searching for two separate infrastructure partners: an issuer processor to facilitate card issuance, and a banking provider to facilitate payments from users. “We talked with many BaaS and card issuer processors, but we just didn’t fit into their pre-existing models,” Matan said. “They wanted to place requirements on our users that didn’t seem relevant.” Partnering with a separate banking provider also meant increased costs and delays in crediting payments. “We either needed to absorb wire fees or accept the credit risk related to delayed ACH payments,” said Matan. All of these factors ultimately increased the complexity of their systems and the cost of capital.

Existing solutions also lacked the customization and transparency that CapitalOS needed. An important part of building an embedded charge card program is being able to provide powerful controls for end users, but this requires granular access to the underlying network data. “It was really important for us to be in the authorization flow, but few providers offered this,” said Matan. This left the team with the difficult tradeoff of either expending significant resources building a direct integration with Visa, or accepting less visibility into their system. “Higher visibility helps lower fraud risk and strengthen differentiation, which ultimately creates a better and more cost effective experience for the businesses we serve.”

“Higher visibility helps lower fraud risk and strengthen differentiation, which ultimately creates a better and more cost effective experience for the businesses we serve.”

From Matan’s perspective, the existing options didn’t provide the autonomy, visibility, or speed needed to build a differentiated product. “To be successful, we need to provide platforms with a spend management product that is at least as good as an in house solution.”

The solution

With Increase, CapitalOS was able to create a customized compliance program, build a capital efficient funding model, and configure powerful spend controls based on low-level network data. “Increase’s approach to tailored compliance, matched with the ways they’ve verticalized payments and card issuance into a powerful set of APIs, has been uniquely valuable,” said Matan.

With Increase and our bank partner, CapitalOS established a delegated compliance model that allowed them to perform their own KYB/KYC checks while maintaining strict compliance requirements. “This was a huge paradigm shift for us. It’s enabled us to build our policy in a way that better meets our customer needs,” he said. After aligning on well-considered and regulatory compliant workflows, the team rolled out real-time onboarding for new businesses.

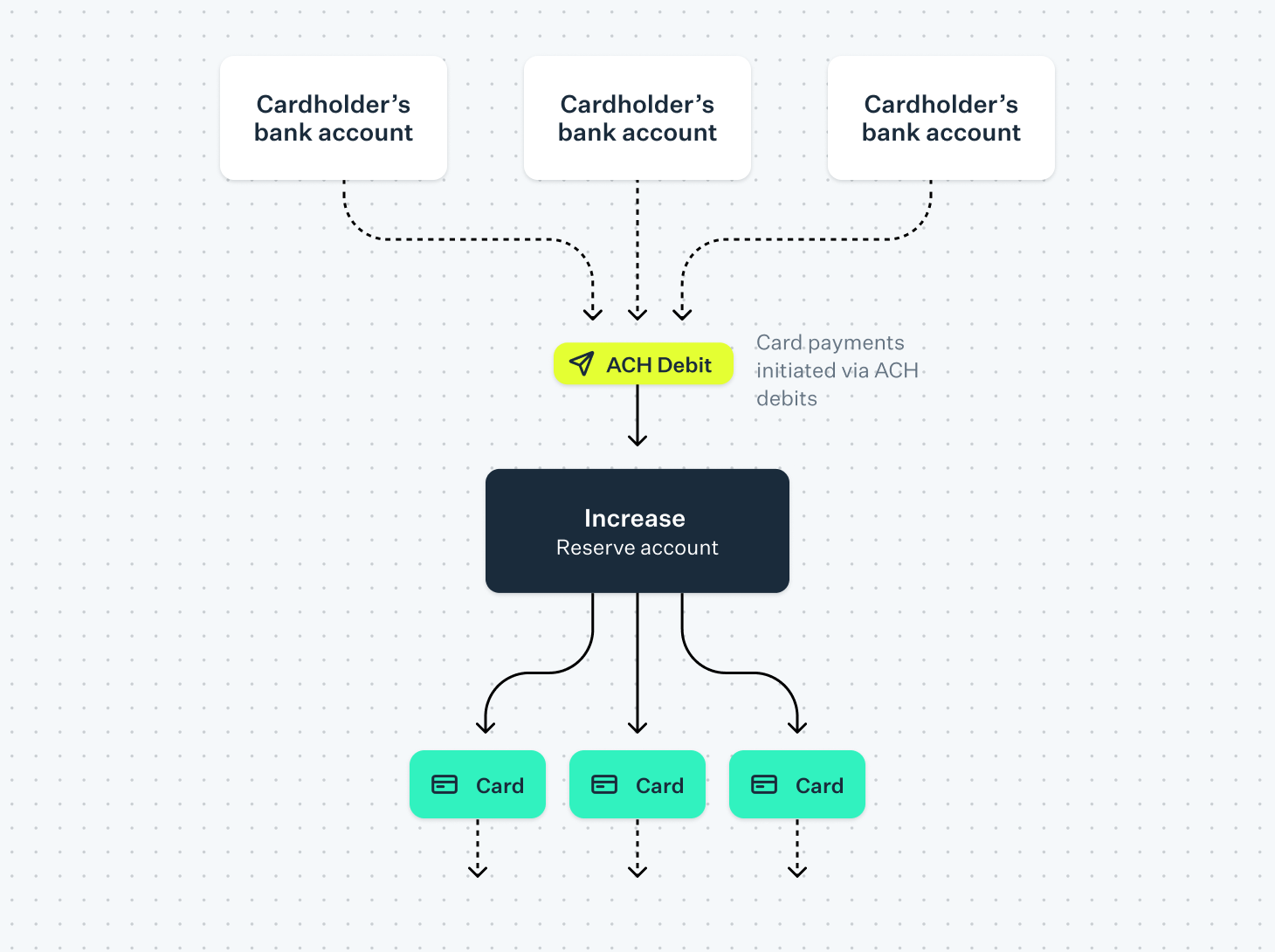

When considering their credit structure, the team also had to determine how to manage reserves and credit payments from the businesses they serve. By using Bank Accounts and ACH Transfers bundled together with Cards, CapitalOS built their entire funds flow on Increase, reducing complexity and cost of capital. “We've been able to turn these savings into novel features for our users, like instant payment credits, which is extremely valuable to cashflow constrained small businesses.”

With Increase and our bank partner, CapitalOS established a delegated compliance model that allowed them to perform their own KYB/KYC checks while maintaining strict compliance requirements. “This was a huge paradigm shift for us. It’s enabled us to build our policy in a way that better meets our customer needs,” he said. After aligning on well-considered and regulatory compliant workflows, the team rolled out real-time onboarding for new businesses.

When considering their credit structure, the team also had to determine how to manage reserves and credit payments from the businesses they serve. By using Bank Accounts and ACH Transfers bundled together with Cards, CapitalOS built their entire funds flow on Increase, reducing complexity and cost of capital. “We've been able to turn these savings into novel features for our users, like instant payment credits, which is extremely valuable to cashflow constrained small businesses.”

The team also leverages Increase to issue, customize, and ship physical cards on demand entirely via the API. “Competitors quoted 6-8 weeks to get cards in the hands of our customers. With Increase, we can create and ship physical cards in 1-2 days,” Matan said. With direct access to the authorization flow, the team is able to approve or deny any authorization, which provides greater control over fraud. Additionally, they leverage low level Visa protocols to build specialized spending controls for products like Fuel Cards. “When we go to customers, oftentimes they've evaluated what it means to build this in-house beforehand. But the speed and depth of control we get with Increase has been a real differentiator for us. We’re materially faster than competitors, and can provide a full featured solution that’s easy for businesses to integrate with.”

“Competitors quoted 6-8 weeks to get cards in the hands of our customers. With Increase, we can create and ship physical cards in 1-2 days.”

The result

Integration with Increase enabled CapitalOS to provide a more robust card issuance product with greater speed and customization compared to alternatives. “The engineering expertise and speed with which Increase moves has been substantial,” Matan said. “We look forward to continuing to design and build products with Increase as we scale.”

Increase is not a bank. Banking products and services are offered by Grasshopper Bank, N.A., Member FDIC, First Internet Bank of Indiana, Member FDIC, and Core Bank, Member FDIC. Cards Issued by First Internet Bank of Indiana, pursuant to a license from Visa Inc. Deposits are insured by the FDIC up to the maximum allowed by law through Grasshopper Bank, N.A., Member FDIC, First Internet Bank of Indiana, Member FDIC, and Core Bank, Member FDIC. FDIC deposit insurance only covers the failure of the FDIC insured bank.