Simplified fund administration

Dependable, transparent, and secure tools for managing funds, capital calls, and distributions with ease.

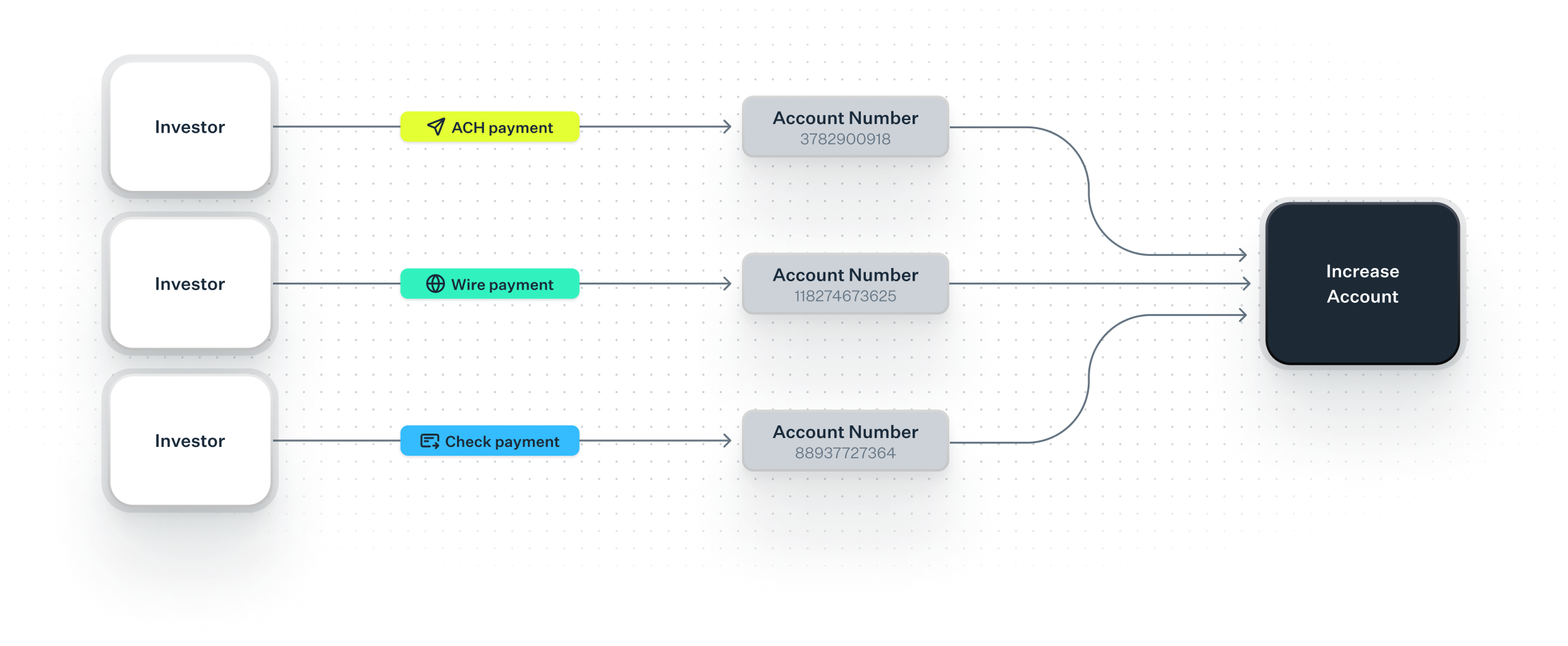

Automate your capital calls and reconciliation

Inbound payments can be hard to link to a specific counterparty because of limited details. With Increase, you can give each counterparty a unique Account Number. This makes it easy to automatically match a received payment to a capital call.

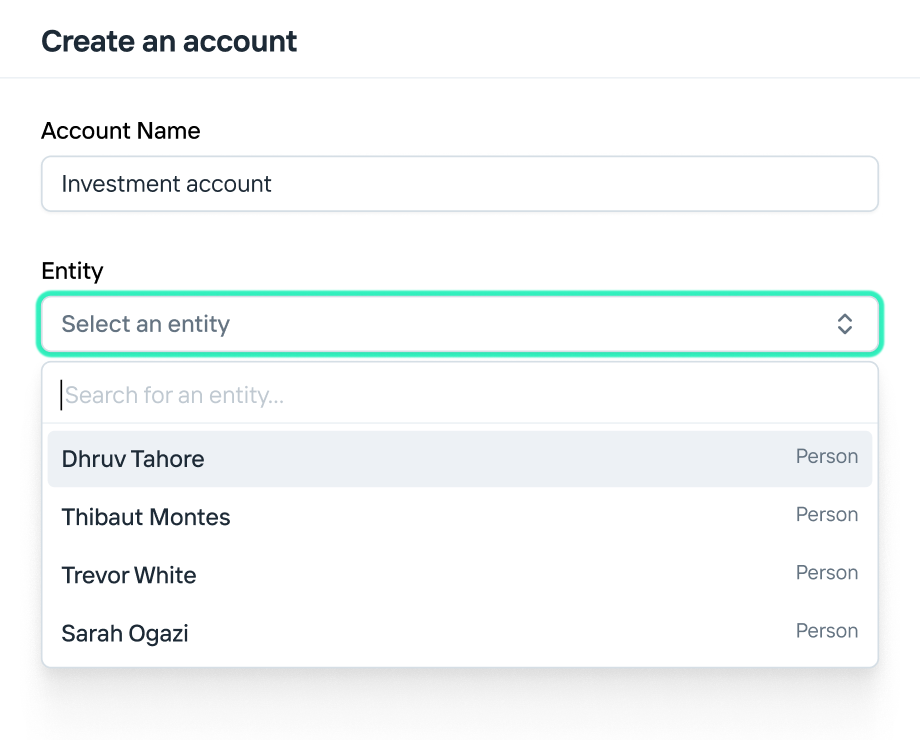

Easily add entities and vehicles

Increase makes adding new Entities and Accounts easy, whether it's a sidecar or a new fund. Our intuitive dashboard streamlines the setup, so you can expand your investment structures with ease.

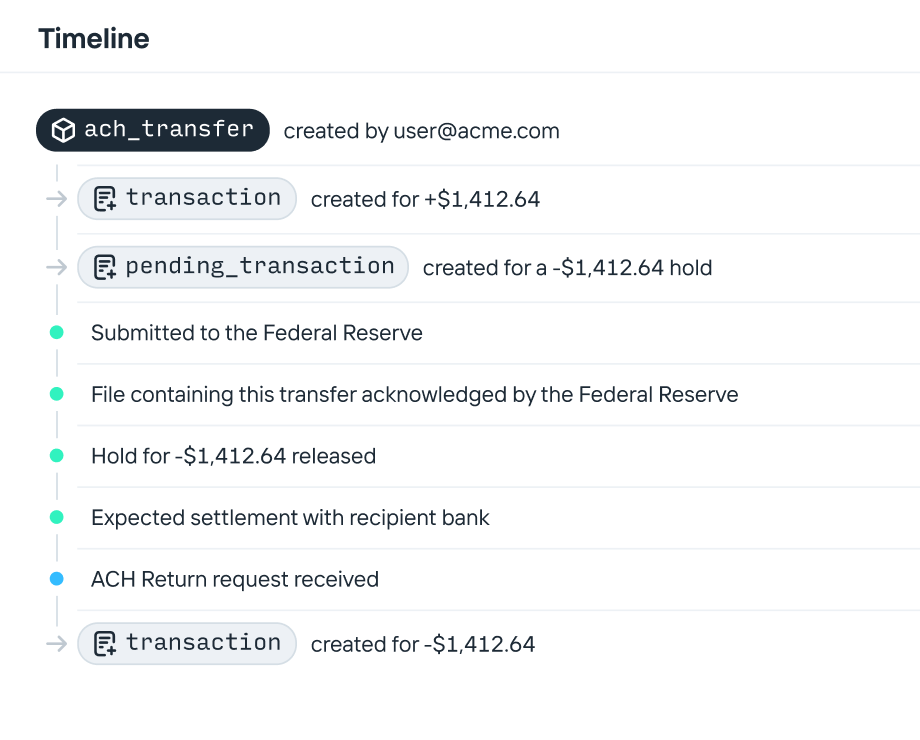

Real-time funds tracking

See the live status of every payment, including when it's submitted to the Federal Reserve, acknowledged, and even returned.

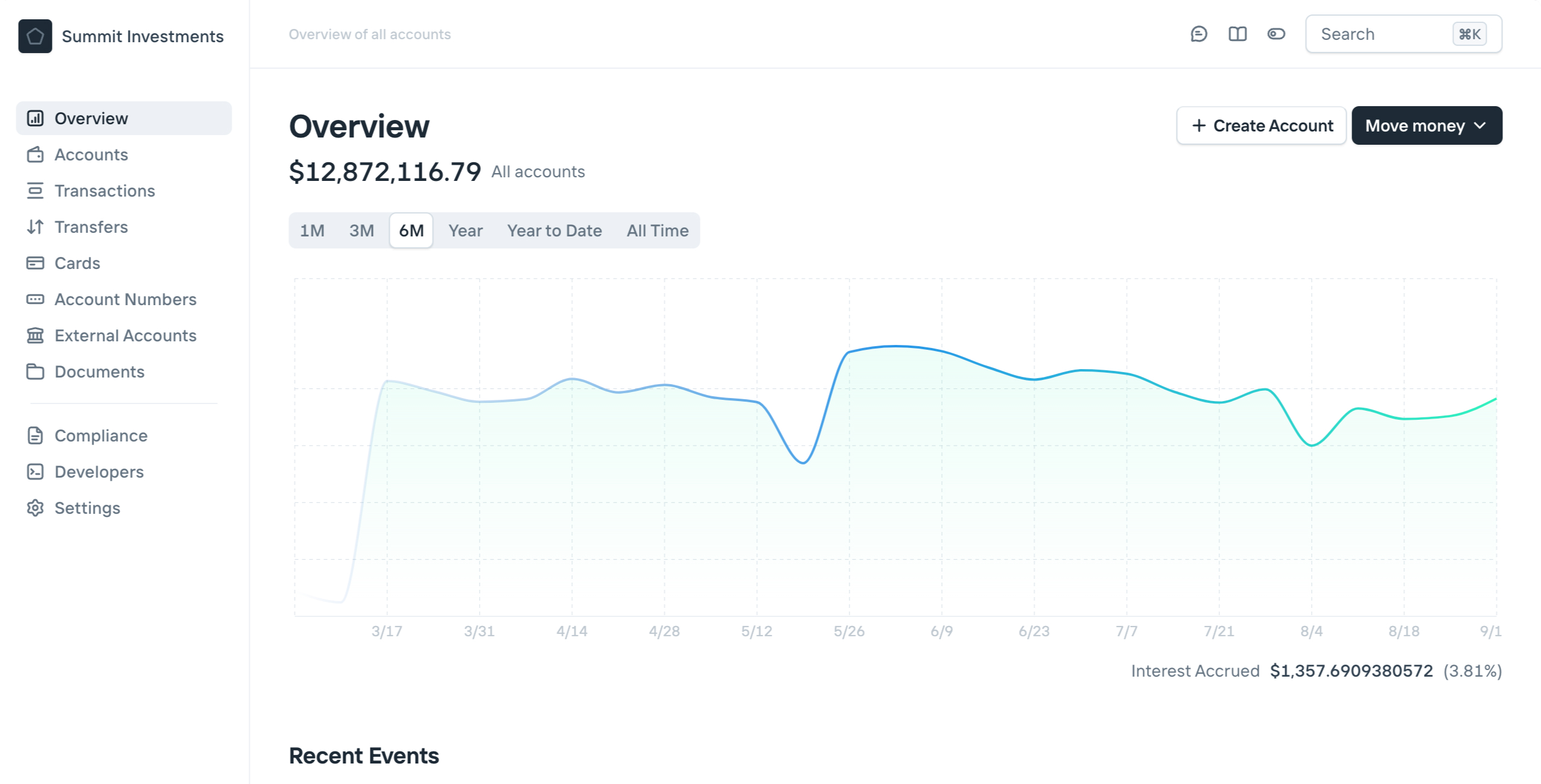

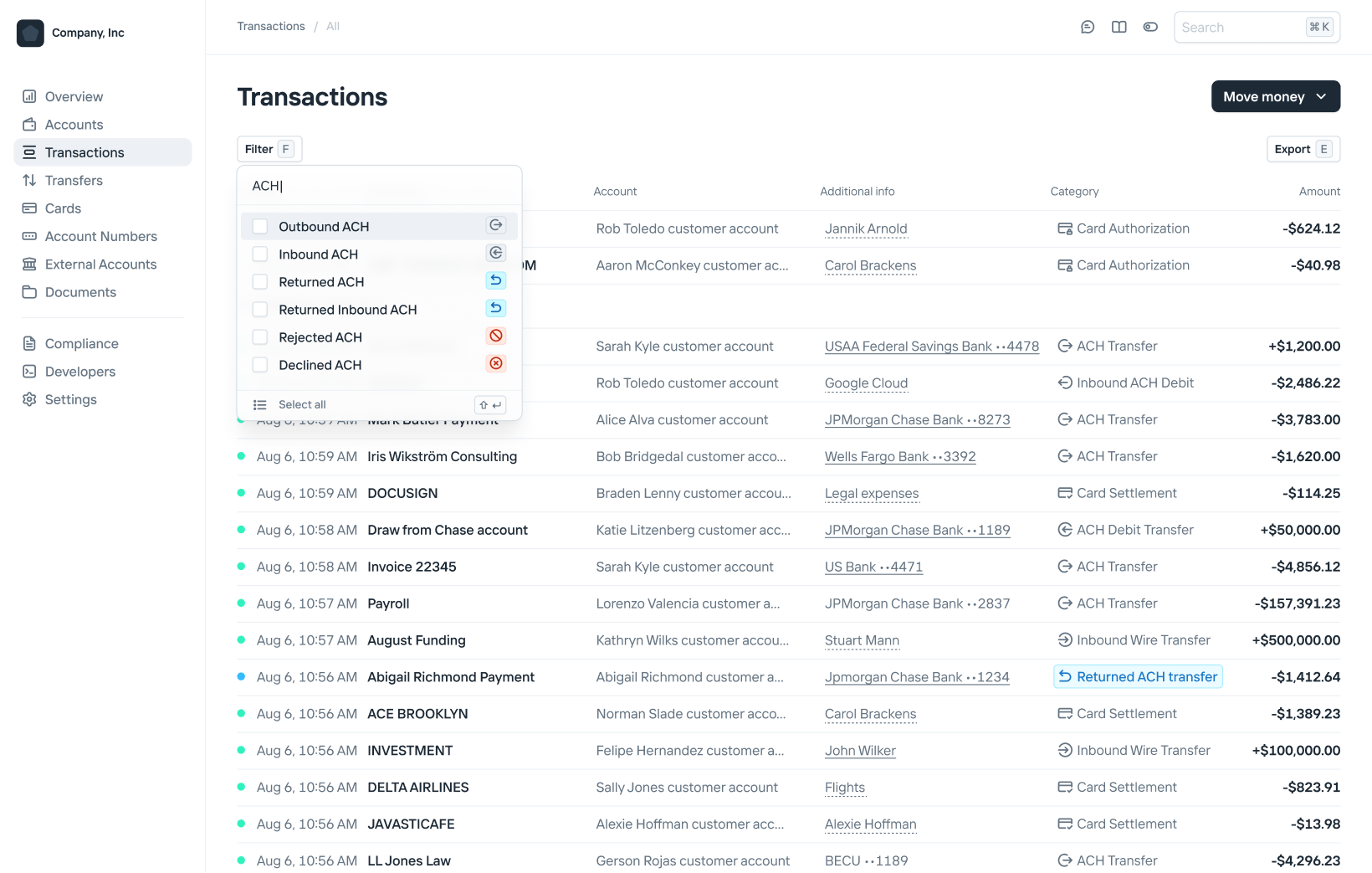

A dashboard built for scaled banking

Manage all of your banking activity in a single, simple interface. Move money, create Accounts, track payments, and much more.

Banking for builders

ACH Payments

Originate ACH credits and debits, validate account numbers with pre-notifications and store commonly accessed details.

Learn more

Bank Accounts

Flexible account constructs with unlimited account numbers.

Learn more

Cards

Issue custom cards to your customers. Approve authorizations in real-time and configure your own limits.

Learn more

Checks

Send branded checks anywhere in the world with one API call. Or deposit checks via API or the dashboard.

Learn more

Wires

The original instantaneous money transfer. Send money anywhere, anytime Fedwire is open.

Learn more

Real-Time Payments

Transmit money to accounts at most major banks in seconds, not days.

Learn more

FedNow

The Federal Reserve’s newest payment method. Quickly move money 24/7/365 with any participating bank.

Learn more

Push-to-Card

Send funds to eligible Visa and Mastercard cards in seconds at any time.

Learn more

Increase is not a bank. Banking products and services are offered by Grasshopper Bank, N.A., Member FDIC, First Internet Bank of Indiana, Member FDIC, and Core Bank, Member FDIC. Cards Issued by First Internet Bank of Indiana, pursuant to a license from Visa Inc. Deposits are insured by the FDIC up to the maximum allowed by law through Grasshopper Bank, N.A., Member FDIC, First Internet Bank of Indiana, Member FDIC, and Core Bank, Member FDIC. FDIC deposit insurance only covers the failure of the FDIC insured bank.