Scale a compliant sponsor banking program

No core integration needed

Increase operates as a standalone parallel core, eliminating the need for dependencies on your current core and saving time and resources.

Support leading fintech clients

Increase helps banks source top-tier fintech leads and facilitates the technology side of their fintech relationships, with banks contracting directly with customers.

Enhanced compliance tools

Increase provides robust compliance tools for both banks and technology companies, including automated checks to ensure all programs run safely and soundly.

End-to-end technical support

From onboarding to ongoing supervision, Increase provides hands-on technical support to help banks and platforms scale programs safely and effectively.

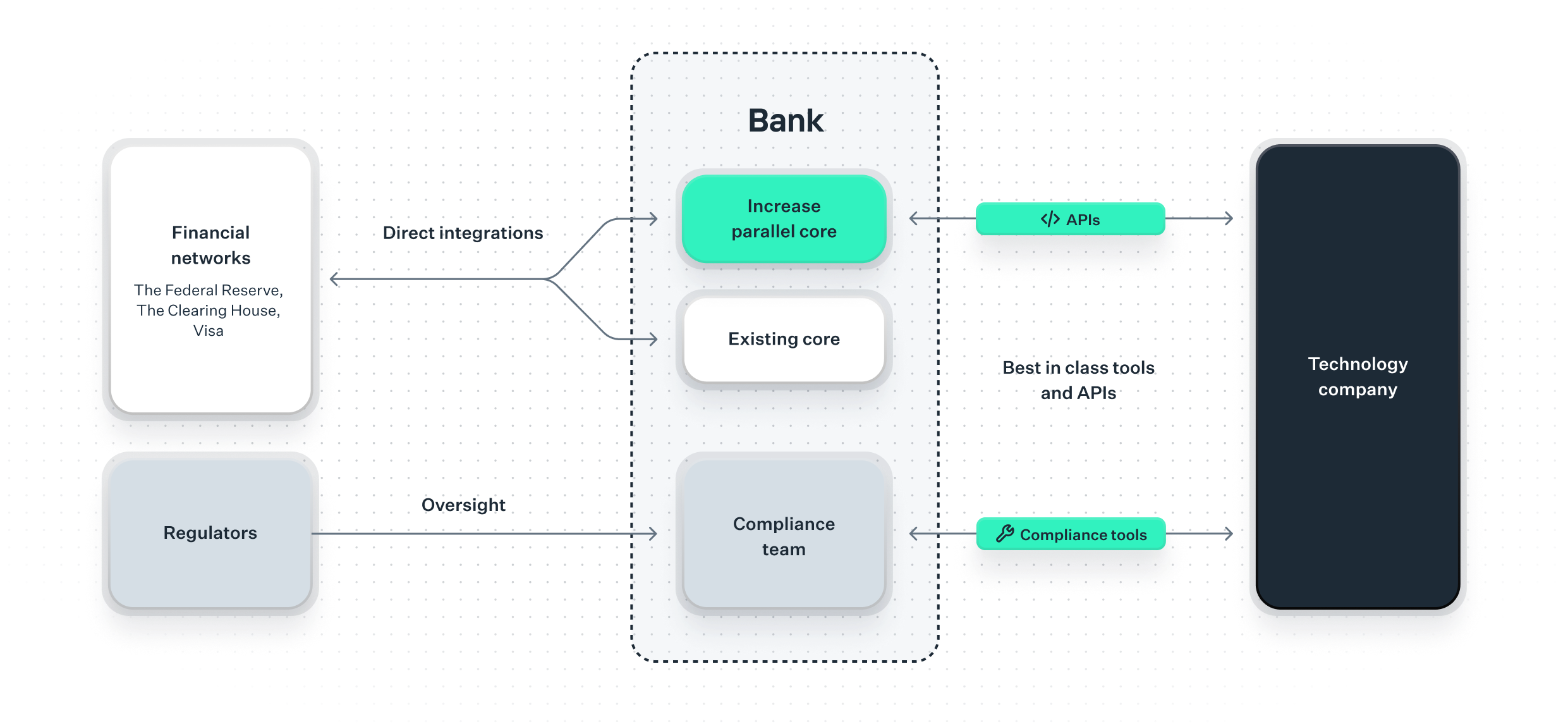

A fully transparent integration model

Best-in-class customer technology

Increase provides a parallel core solution—offering banks full visibility and control over fintech activity while supporting best-in-class APIs and data visibility for technology customers.

Bank-owned compliance

Banks continue to directly manage and oversee their technology company relationships, with compliance tooling designed to support compliant, scalable growth.

Leading infrastructure and tooling

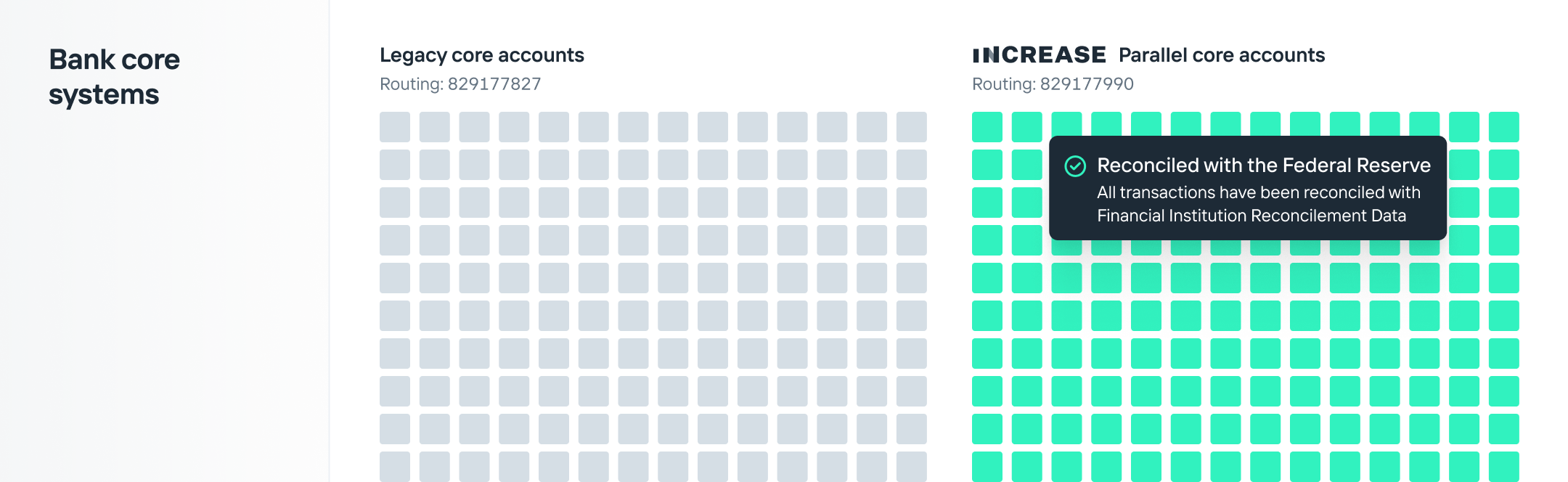

An advanced on-core ledger

The Increase core supports real-time tracking of funds and beneficiaries, as well as reconciliation with the Federal Reserve.

Automated compliance tooling

Simplify monitoring and supervision of fintech programs with automated compliance checks, limit-setting, and detailed supervision tools.

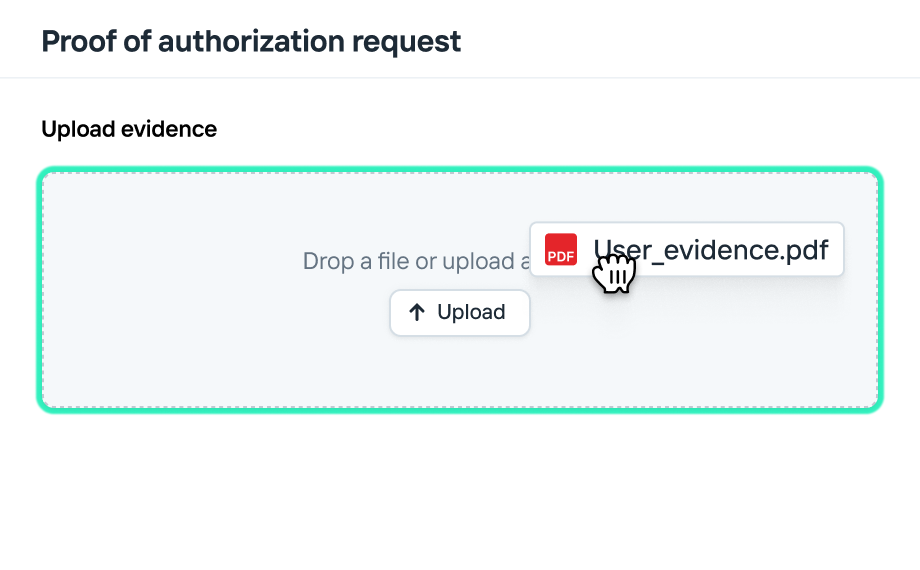

A shared compliance portal

Increase offers a customer-facing portal to facilitate the bank’s collection of supervision documents and key information.

Sponsor new fintech use cases

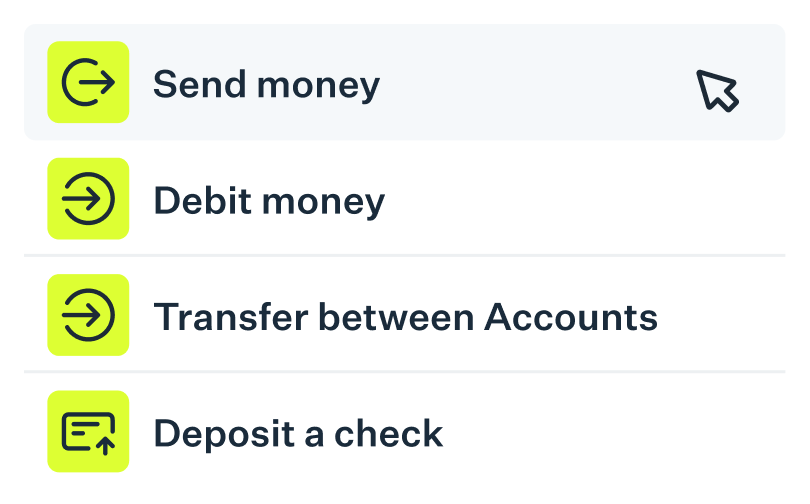

Embedded banking

Offer a complete suite of account management products that technology companies can seamlessly embed into their offerings, from wallets to neo-bank solutions.

Scaled payments

Enable fast, transparent payment methods built for scale with best-in-class infrastructure for leading bill pay and payroll providers.

Card programs

Provide embedded solutions for both virtual and physical cards, empowering technology companies to scale card programs and even offer faster access to capital.