Scalable bill pay infrastructure

Manage payments with unmatched flexibility and control. Programmatically fund, disburse, and reconcile your payment flows effortlessly.

Granular network details

We connect you directly to Federal Reserve networks like FedACH and Check 21 so you can get unfiltered access to data, more stability, and a flexible implementation.

Transparent data

Fewer dependencies

Stability and redundancy

Faster build times

FedACH

Check 21

Fedwire

RTP

01 10105000116022140762301211301A094101BIG BANK IAN CREASE 5200MYCOMPANY INC. 1602214076CCDPAYROLL 230121230121 1123456780000001622123456789987654321000000003502586760 RATCHET INC 0839692747659385622123456789987654321000000003502586760 VENDOR INC 083969274765938562224680135755554442220007894701 10105000116022140762301211301A094101BIG BANK IAN CREASE 5200MYCOMPANY INC. 1602214076CCDPAYROLL 230121230121 1123456780000001622123456789987654321000000003502586760 RATCHET INC 0839692747659385622123456789987654321000000003502586760 VENDOR INC 0839692747659385622246801357555544422200078947

101 0000001ABCBANK01 2024090412001234 010 201 0000001ABC01 123456789987654321 20240904123456789000010001250001 01 1000010012024 000000000125.00 250 000000100000000000000001 1234567891234567890000000000123456789 125.00 20240904 0000000000123AABC1234567 252 000000100000000000000001 FrontImageFilename.TIF 0000000000000000000000 252 000000100000000000000001 BackImageFilename.TIF 0000000000000000000000 701 000000000125.00 00001 00001 901 000000000125.00 00001 00001 101 0000001ABCBANK01 2024090412001234 010 201 0000001ABC01 123456789987654321 20240904123456789000010001250001

31012050001{3600}CTR{4200}D987654321*IAN CREASE*33 LIBERTY STREET*NEW YORK*NY 10045{5000}9ALAN TURING*{6000}*NEW ACCOUNT TRANSFER*{1500}3012345678P {1510}1000{1520}20230118MMQFMP0P000001{2000}000000000100{3100}000000000{3400}101050001{3600}CTR{4200}D987654321*IAN CREASE*33 LIBERTY STREET*NEW31012050001{3600}CTR{4200}D987654321*IAN CREASE*33 LIBERTY STREET*NEW YORK*NY 10045{5000}9ALAN TURING*{6000}*NEW ACCOUNT TRANSFER*{1500}3012345678P {1510}1000{1520}20230118MMQFMP0P000001{2000}000000000100{3100}000000000{3400}101050001{3600}CTR{4200}D987654321*IAN CREASE*33 LIBERTY STREET*NEW

<Messagexmlns:head="urn:iso:std:iso:20022:tech:xsd:head.001.001.01"xmlns:doc="urn:iso:std:iso:20022:tech:xsd:pacs.008.001.08"xmlns:p3="http://www.w3.org/2001/XMLSchema-instance"xmlns="urn:tch"p3:schemaLocation="urn:tchmessages.xsd"><AppHdr><Fr><FIId><FinInstnId><ClrSysMmbId><MmbId>233333377A1<Messagexmlns:head="urn:iso:std:iso:20022:tech:xsd:head.001.001.01"xmlns:doc="urn:iso:std:iso:20022:tech:xsd:pacs.008.001.08"xmlns:p3="http://www.w3.org/2001/XMLSchema-instance"xmlns="urn:tch"p3:schemaLocation="urn:tchmessages.xsd"><AppHdr><Fr><FIId><FinInstnId><ClrSysMmbId><MmbId>233333377A1

Fast by default, instant when you need it

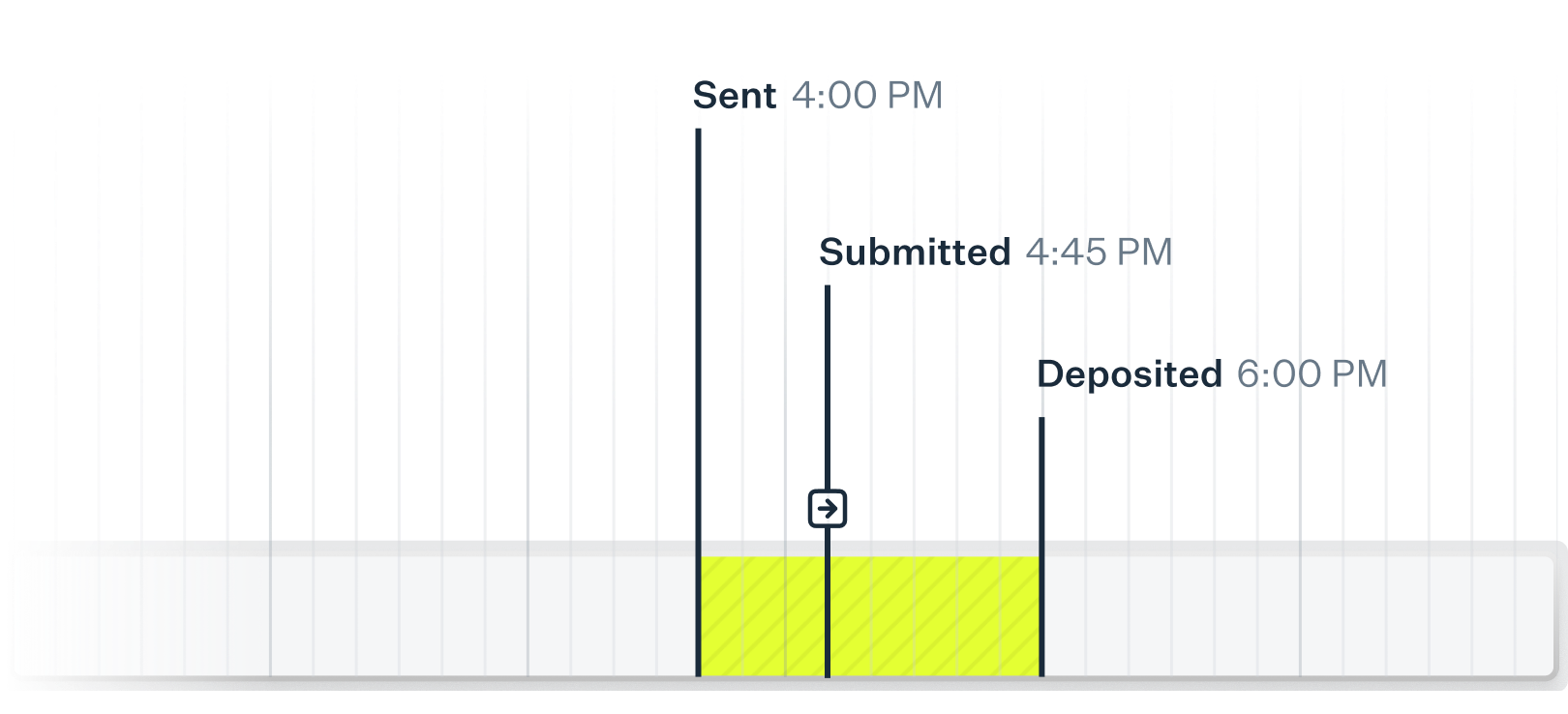

Hit any Same-day ACH window for settlement within hours, send money instantly with Wires and Real-Time Payments, or leverage traditional Check payments in a programmatic way.

Built-in reconciliation

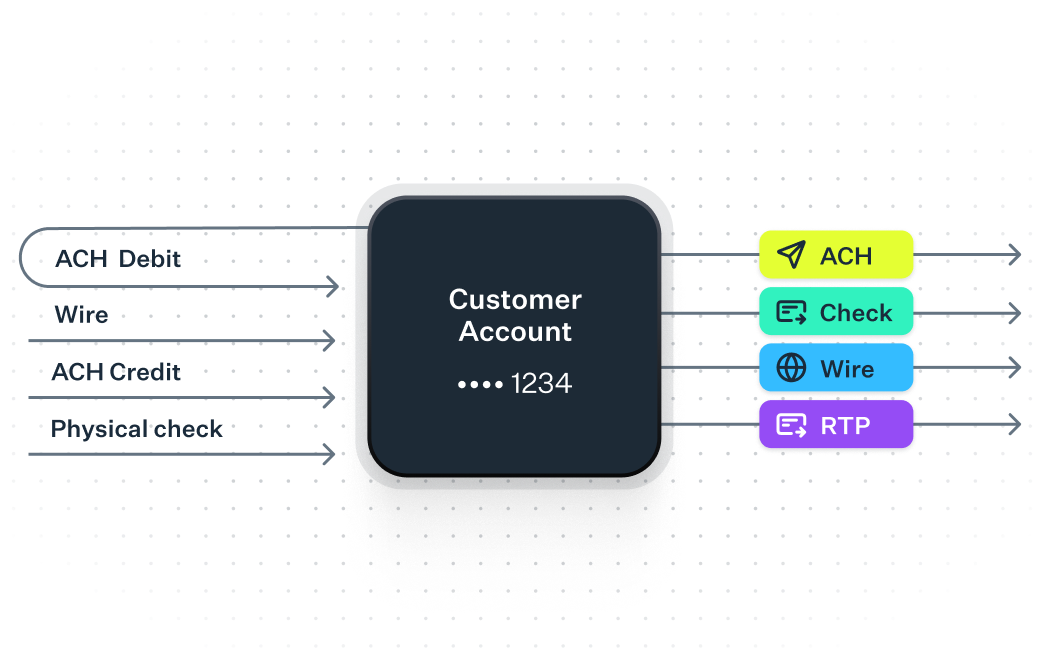

Create unique Accounts for each customer, ensuring that funds are always segmented and reconciled. You can fund Accounts by either pulling money via ACH debits, or receiving money by Wire, ACH, Check deposit, or RTP to unique Account Numbers.

Easy exception handling

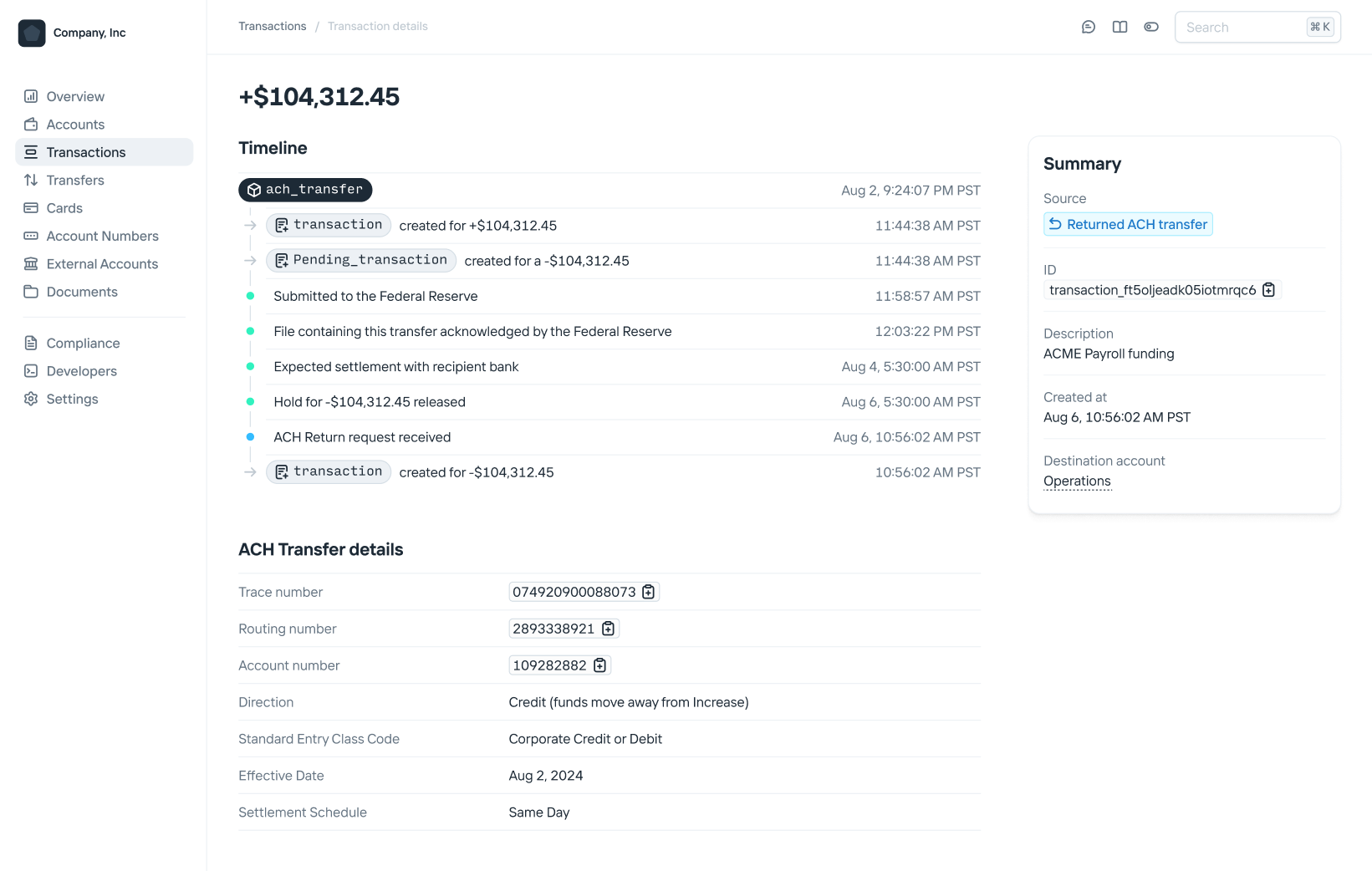

Monitor when a payment is created, submitted, acknowledged, and even returned. With ACH and Check returns automatically correlated with their originating transfers, it’s simple to track and resolve exceptions.

Banking for builders

ACH Payments

Originate ACH credits and debits, validate account numbers with pre-notifications and store commonly accessed details.

Learn more

Bank Accounts

Flexible account constructs with unlimited account numbers.

Learn more

Cards

Issue custom cards to your customers. Approve authorizations in real-time and configure your own limits.

Learn more

Checks

Send branded checks anywhere in the world with one API call. Or deposit checks via API or the dashboard.

Learn more

Wires

The original instantaneous money transfer. Send money anywhere, anytime Fedwire is open.

Learn more

Real-Time Payments

Transmit money to accounts at most major banks in seconds, not days.

Learn more

FedNow

The Federal Reserve’s newest payment method. Quickly move money 24/7/365 with any participating bank.

Learn more

Push-to-Card

Send funds to eligible Visa and Mastercard cards in seconds at any time.

Learn more

Increase is not a bank. Banking products and services are offered by Grasshopper Bank, N.A., Member FDIC, First Internet Bank of Indiana, Member FDIC, and Core Bank, Member FDIC. Cards Issued by First Internet Bank of Indiana, pursuant to a license from Visa Inc. Deposits are insured by the FDIC up to the maximum allowed by law through Grasshopper Bank, N.A., Member FDIC, First Internet Bank of Indiana, Member FDIC, and Core Bank, Member FDIC. FDIC deposit insurance only covers the failure of the FDIC insured bank.