Same-day by default

Send ACH payments that settle in as little as a few hours.

Flexible account numbers

Automate reconciliation with unique account numbers for every counterparty.

Faster access to funds

Instantly access debited funds when you maintain a reserve account.

Transparent funds availability

Know precisely when your transfers are submitted and available.

Passthrough codes

View return codes and standard entry class codes directly.

Correlated returns

Returns are automatically and reliably correlated.

Stable company identifiers

Easily create reliable statement descriptors.

Saved counterparties

Save external account details for repeat payments.

Stable and reliable

Predictably fast ACH payments

ACH payments can feel like a black box. They can take several business days to complete and it’s unclear when funds will be available.

We offer same-day ACH, submit at every Fed window, and provide robust settlement tracking. This means that your payments can arrive in less than 24 hours—often even quicker.

Send same-day ACH

Submissions at every ACH window

Transparent settlement tracking

Complete control

Preview every inbound payment

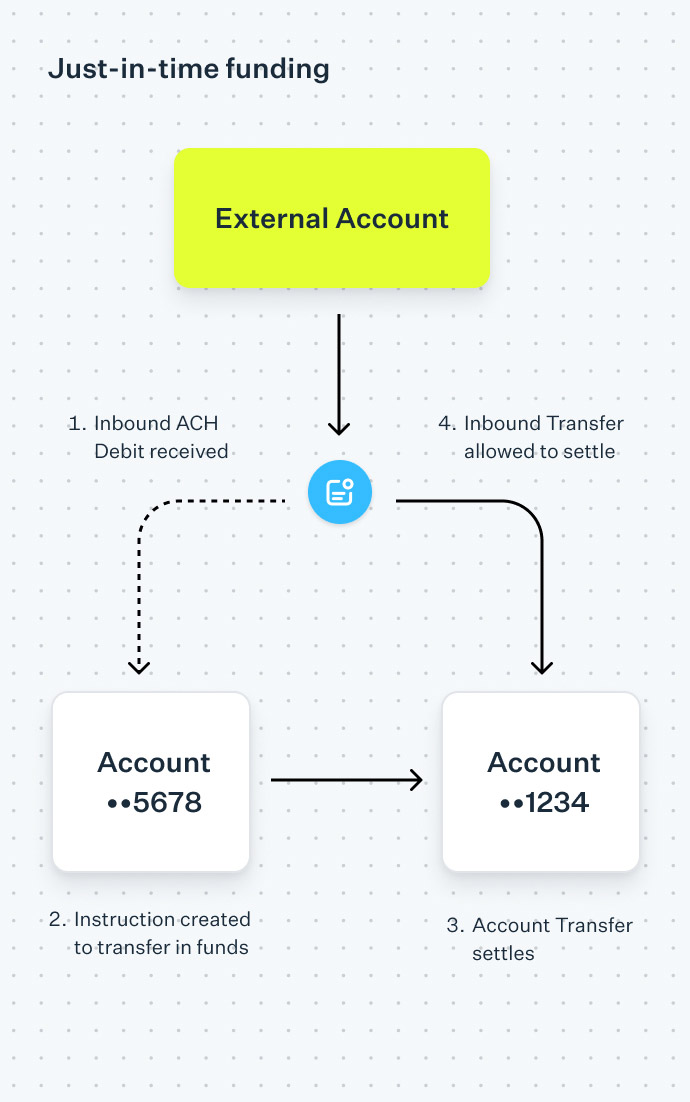

Increase lets you preview incoming ACH transfers for one hour before allocating them. This gives you flexibility to reject unwanted debits or fund accounts just-in-time. For advanced use cases, create your own allow or disallow lists and write specialized rules or limits.

Just-in-time funding

Custom allow and disallow lists

Auto-reject unwanted transfers

Raw return codes

return_reason_codeUnderstand the specific reason for a returned payment with these 80+ codes.

Trace identifiers

trace_numberProvide a recipient with proof that a payment has been sent.

Company identifiers

company_nameCraft predictable statement descriptors for recipients.

Addenda

addendumAttach remittance information such as an invoice number.

Standard entry class codes

standard_entry_class_codeDeclare the kind of payments you’re sending with this three-character code, like a direct deposit or bill payment (PPD).

Operator workflows

Always know where your money is

Track the status of ACH payments directly from the Increase dashboard. View which transactions are awaiting submission, preview when funds will arrive, and monitor returns.

Banking for builders

ACH Payments

Originate ACH credits and debits, validate account numbers with pre-notifications and store commonly accessed details.

Learn more

Bank Accounts

Flexible account constructs with unlimited account numbers.

Learn more

Cards

Issue custom cards to your customers. Approve authorizations in real-time and configure your own limits.

Learn more

Checks

Send branded checks anywhere in the world with one API call. Or deposit checks via API or the dashboard.

Learn more

Wires

The original instantaneous money transfer. Send money anywhere, anytime Fedwire is open.

Learn more

Real-Time Payments

Transmit money to accounts at most major banks in seconds, not days.

Learn more

FedNow

The Federal Reserve’s newest payment method. Quickly move money 24/7/365 with any participating bank.

Learn more

Push-to-Card

Send funds to eligible Visa and Mastercard cards in seconds at any time.

Learn more

Increase is not a bank. Banking products and services are offered by Grasshopper Bank, N.A., Member FDIC, First Internet Bank of Indiana, Member FDIC, and Core Bank, Member FDIC. Cards Issued by First Internet Bank of Indiana, pursuant to a license from Visa Inc. Deposits are insured by the FDIC up to the maximum allowed by law through Grasshopper Bank, N.A., Member FDIC, First Internet Bank of Indiana, Member FDIC, and Core Bank, Member FDIC. FDIC deposit insurance only covers the failure of the FDIC insured bank.