Customer story

Check partners with Increase to enable reliable, transparent payroll solutions

About Check

Check is a leading embedded payroll infrastructure, giving businesses the ability to integrate payroll directly into their platforms. Whether those platforms are designed for coffee shops or construction companies, Check ensures their payroll operations run efficiently – supporting thousands of businesses and hundreds of thousands of employees. Their mission is to simplify payroll, making it seamless, scalable, and accessible to platforms of all shapes and sizes. However, achieving this goal requires more than functional software—it depends on having high visibility into the underlying financial networks and access to faster payment methods, areas where traditional banking partnerships can fall short.

The challenge: gaining control over critical payment flows

Running payroll at scale presents unique challenges. Without insight into payment processes, it’s difficult to prevent disruptions or respond quickly when issues arise. Check discovered that the limited transparency from its banking partners created obstacles that constrained proactive troubleshooting.

“In payments, things can go wrong at multiple points,” explains Andrew Brown, CEO at Check. “Without clear insight, it's hard to maintain the level of reliability that’s essential for critical payments like payroll. You need to know exactly where each payment is at any moment to operate confidently. Effectively, the more visibility we have, the better.”

“In payments, things can go wrong at multiple points,” explains Andrew Brown, CEO at Check. “Without clear insight, it's hard to maintain the level of reliability that’s essential for critical payments like payroll. You need to know exactly where each payment is at any moment to operate confidently. Effectively, the more visibility we have, the better.”

The solution: real-time visibility with Increase

With Increase, Check has gained full access to the underlying financial network details, with no abstractions. This allows for complete end-to-end visibility into the payment lifecycle, so Check can get ahead of any issues that may arise.

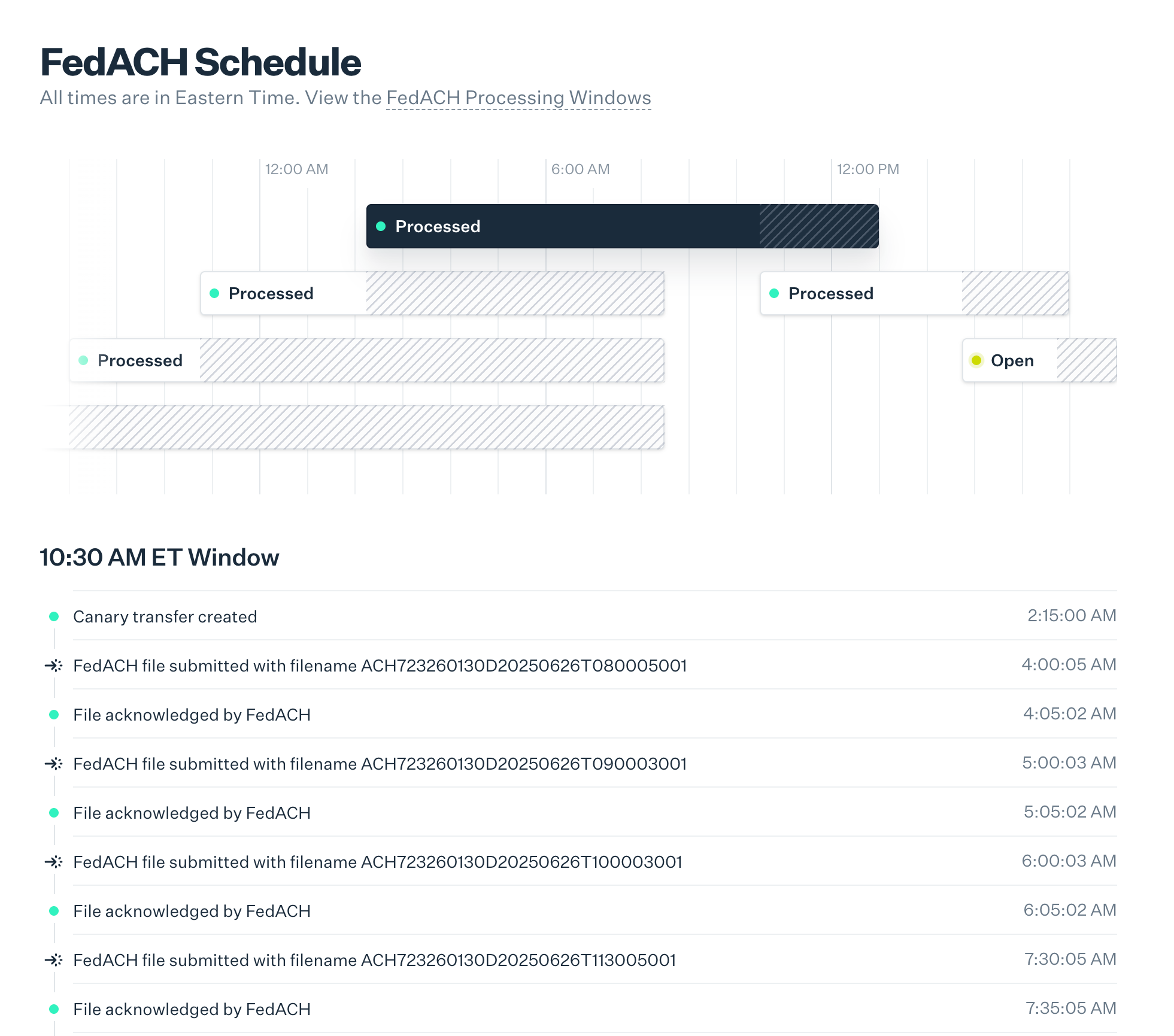

First, Increase offers Check visibility into our canary transfer system. These are Increase-to-Increase ACH transfers that are sent constantly throughout the day. One is included in every file submitted to the Federal Reserve. Doing this lets Increase put a precise timestamp on every transfer that was submitted, acknowledged, and settled.

Increase surfaces canary transfers on our status page, so Check can monitor the submission deadline and processing times for ACH windows in real time, and see the timestamps of canary submissions, as well as acknowledgements and settlements from the Federal Reserve. This ensures Check’s team that the system is functioning correctly—which is especially important on Thursday evenings, ahead of Friday morning payroll landing for their clients’ customers.

First, Increase offers Check visibility into our canary transfer system. These are Increase-to-Increase ACH transfers that are sent constantly throughout the day. One is included in every file submitted to the Federal Reserve. Doing this lets Increase put a precise timestamp on every transfer that was submitted, acknowledged, and settled.

Increase surfaces canary transfers on our status page, so Check can monitor the submission deadline and processing times for ACH windows in real time, and see the timestamps of canary submissions, as well as acknowledgements and settlements from the Federal Reserve. This ensures Check’s team that the system is functioning correctly—which is especially important on Thursday evenings, ahead of Friday morning payroll landing for their clients’ customers.

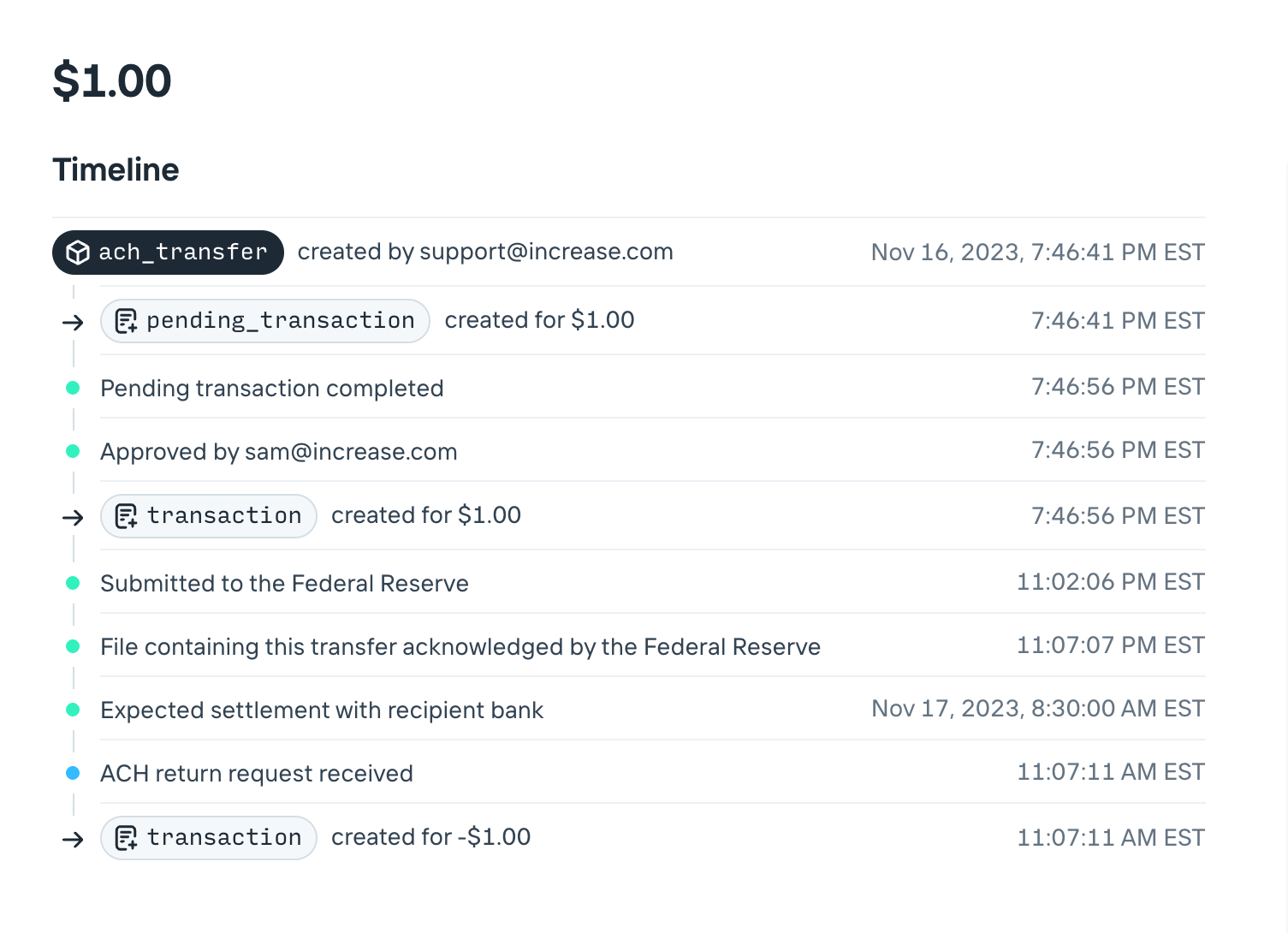

Importantly, Check gets the same level of visibility into the payments they initiate through Increase’s systems. For example, an operator from Check’s team can check the Dashboard Timeline for real-time updates on every step of an ACH Transfer. They can clearly see when transfers were created, and by whom; if transfers require approval, who approved the transfer and when; balance changes precisely timestamped; when files were submitted to the Federal Reserve, and when they’re acknowledged. Any returns get automatically correlated and surfaced in the same timeline.

These tools allow Check to monitor payment flows and resolve issues before they impact customers. “With Increase, we have high confidence that systems are running smoothly. And if something goes wrong, we can quickly drill down into the issue and act before it affects payroll,” adds Andrew. “This level of control has been critical for us.”

“With Increase, we have high confidence that systems are running smoothly. And if something goes wrong, we can quickly drill down into the issue and act before it affects payroll.”

The outcome: dependable payroll at scale

Check has processed billions of dollars through Increase’s platform, with the visibility and operational control needed to scale efficiently.

“The transparency and agility Increase provides have been transformative,” says Andrew. “It lets us focus on building innovative payroll solutions without being bogged down by infrastructure limitations.” As Check continues to grow, its partnership with Increase ensures that businesses across the country can run payroll swiftly and without delays, delivering reliable service at scale.

“The transparency and agility Increase provides have been transformative,” says Andrew. “It lets us focus on building innovative payroll solutions without being bogged down by infrastructure limitations.” As Check continues to grow, its partnership with Increase ensures that businesses across the country can run payroll swiftly and without delays, delivering reliable service at scale.

Products used

ACH Payments

Increase is not a bank. Banking products and services are offered by Grasshopper Bank, N.A., Member FDIC, First Internet Bank of Indiana, Member FDIC, and Core Bank, Member FDIC. Cards Issued by First Internet Bank of Indiana, pursuant to a license from Visa Inc. Deposits are insured by the FDIC up to the maximum allowed by law through Grasshopper Bank, N.A., Member FDIC, First Internet Bank of Indiana, Member FDIC, and Core Bank, Member FDIC. FDIC deposit insurance only covers the failure of the FDIC insured bank.