Customer stories

How Ramp scaled a successful bill pay product with Increase

Ramp is the ultimate platform for modern finance teams. From spend management and expense management software, to bill payments and vendor management, Ramp’s all-in-one solution is designed to automate finance operations and build healthier businesses. Over 15,000 businesses have switched to Ramp to cut their expenses by an average of 5% and close their books 8x faster.

The problem

In October 2021, Ramp introduced its innovative Bill Pay solution, aimed at helping free users from the time-consuming burden of managing their monthly accounts payable. Yet, as the platform expanded its reach, it encountered challenges in tracking the lifecycle of individual bill payments, and faced operational inefficiencies when onboarding new accounts.

“Our former banking partner just didn’t have the flexibility or control we wanted,” said Nik Koblov, Ramp’s Head of Engineering. “We had to call a support person to get access to 250 virtual accounts at a time. It was also really difficult tracking the settlement for our payments.” With increasing friction as their Bill Pay product grew, it became a priority for the team to pivot to a new system.

“Our former banking partner just didn’t have the flexibility or control we wanted,” said Nik Koblov, Ramp’s Head of Engineering. “We had to call a support person to get access to 250 virtual accounts at a time. It was also really difficult tracking the settlement for our payments.” With increasing friction as their Bill Pay product grew, it became a priority for the team to pivot to a new system.

The solution

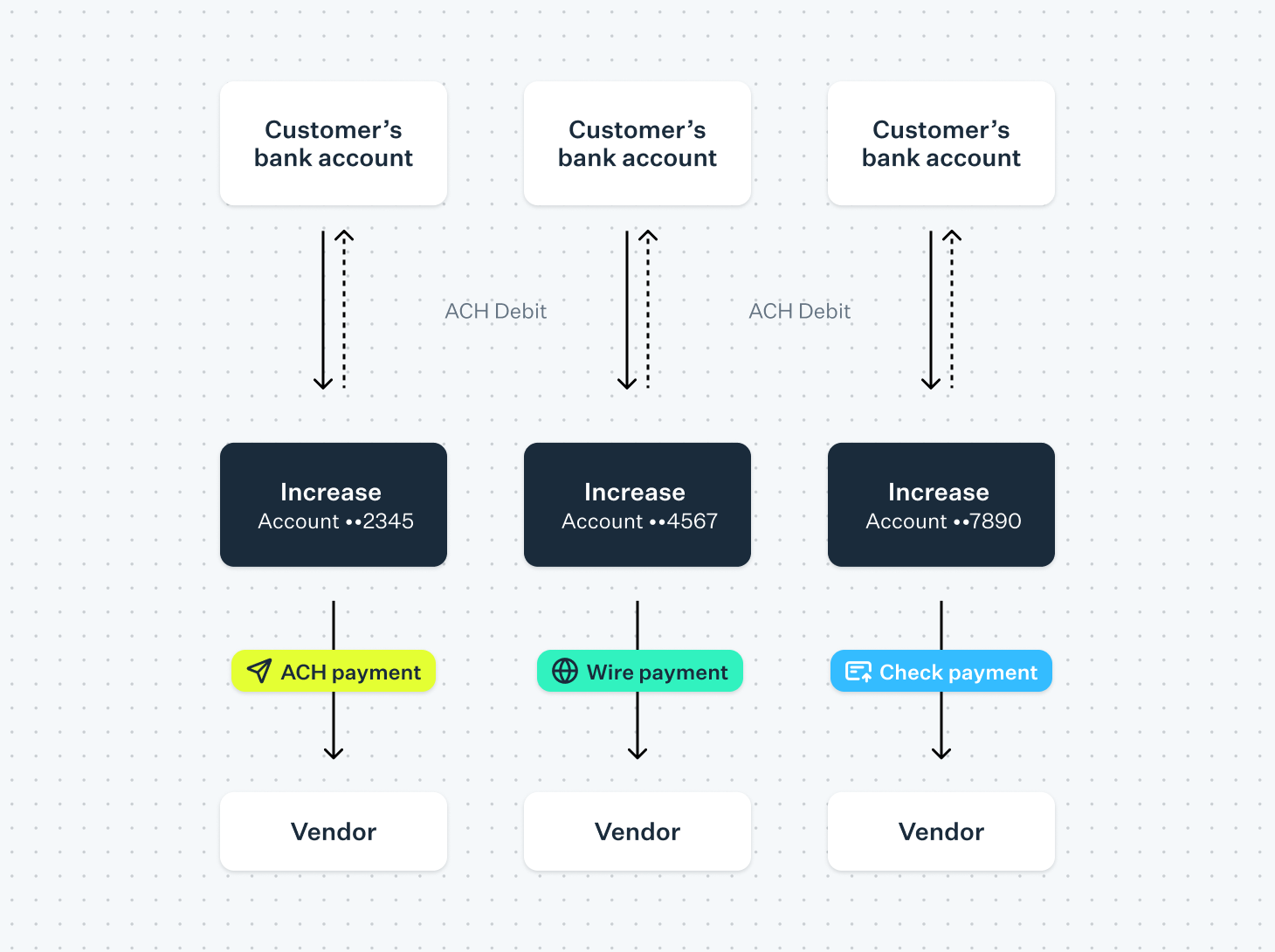

Ramp partnered with Increase to build a robust platform for their Bill Pay product. Ramp spins up unique accounts per user, allowing the team to programmatically track payments instead of needing to parse through a single, massive ledger. They also use Increase’s ACH product to submit bill payments to the Federal Reserve through all 3 same-day ACH windows, and ingest webhooks for each step in the transfer life-cycle. This not only speeds up the payments process, but also allows Ramp to access much more in-depth settlement tracking.

“Increase has provided us with low level access to the underlying payment rails which has substantially improved the stability of our product. The transparency is second to none,” mentioned Nik Koblov. “We know exactly when payments are submitted and when funds are available. Working with Increase has allowed us to have fine-grained controls over every part of our funds flows.”

Using Increase has also helped the Ramp Payments Platform team to build better internal infrastructure. “The Increase API is the best I’ve used. It’s a breath of fresh air,” said Krish Dholakiya, an engineer on Ramp’s payments team. “In addition to building our product flows, we need to build internal APIs for teams with vastly different needs. Because Increase provides such well-reasoned abstractions, we’re able to surface just the right amount of data to each team.”

Using Increase has also helped the Ramp Payments Platform team to build better internal infrastructure. “The Increase API is the best I’ve used. It’s a breath of fresh air,” said Krish Dholakiya, an engineer on Ramp’s payments team. “In addition to building our product flows, we need to build internal APIs for teams with vastly different needs. Because Increase provides such well-reasoned abstractions, we’re able to surface just the right amount of data to each team.”

“Increase has provided us with low level access to the underlying payment rails which has substantially improved the stability of our product. The transparency is second to none.”

The result

With the help of this new model, Ramp saw a surge of growth in their Bill Pay product. “Our Bill Pay product has been a game changer, and Increase has been an invaluable partner in that process,” said Nik. “We’re processing millions of payments with Increase and are excited and confident about how we’ll grow together in the future.”

Millions

of successful payments sent

Thousands

of businesses pay their bills with Ramp

Increase is not a bank. Banking products and services are offered by Grasshopper Bank, N.A., Member FDIC, First Internet Bank of Indiana, Member FDIC, and Core Bank, Member FDIC. Cards Issued by First Internet Bank of Indiana, pursuant to a license from Visa Inc. Deposits are insured by the FDIC up to the maximum allowed by law through Grasshopper Bank, N.A., Member FDIC, First Internet Bank of Indiana, Member FDIC, and Core Bank, Member FDIC. FDIC deposit insurance only covers the failure of the FDIC insured bank.