Article

Announcing Lockboxes: Programmatically deposit checks with your own virtual mailbox

Paper checks are a practical and widespread form of payment. Writing an amount and your signature on a slip of paper is easy to understand and simple to do. In 2023 alone, the Federal Reserve collected over $8.45 trillion in commercial checks[0]. Digital transfer mechanisms are growing, but the good-old-fashioned physical check is still relied upon and essential for many payment flows.

However, checks are slow and tedious to manage. They sometimes take weeks (or even months!) to be deposited after making it to the recipients’ mailbox. If you’re sending or depositing checks at scale, managing these slips of paper can be a significant headache. This is why we’ve built a fully digital check processing system.

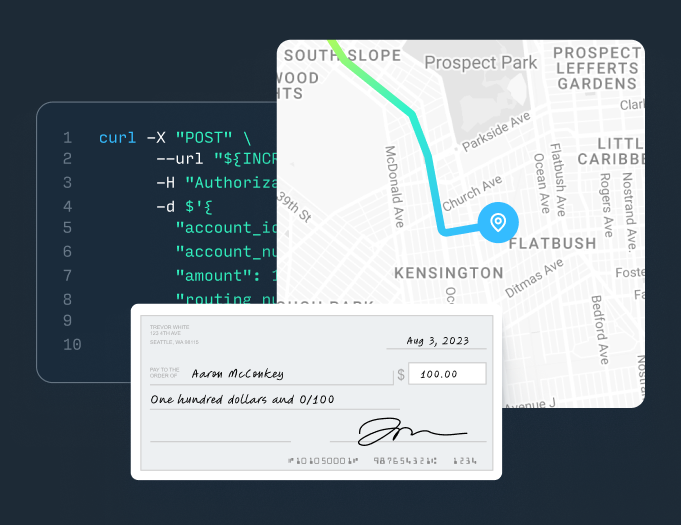

Increase’s API and Dashboard allow efficient, programmatic access to mail checks, deposit check images, and — starting this month — host a virtual mailbox to accept payments in your designated check lockbox.

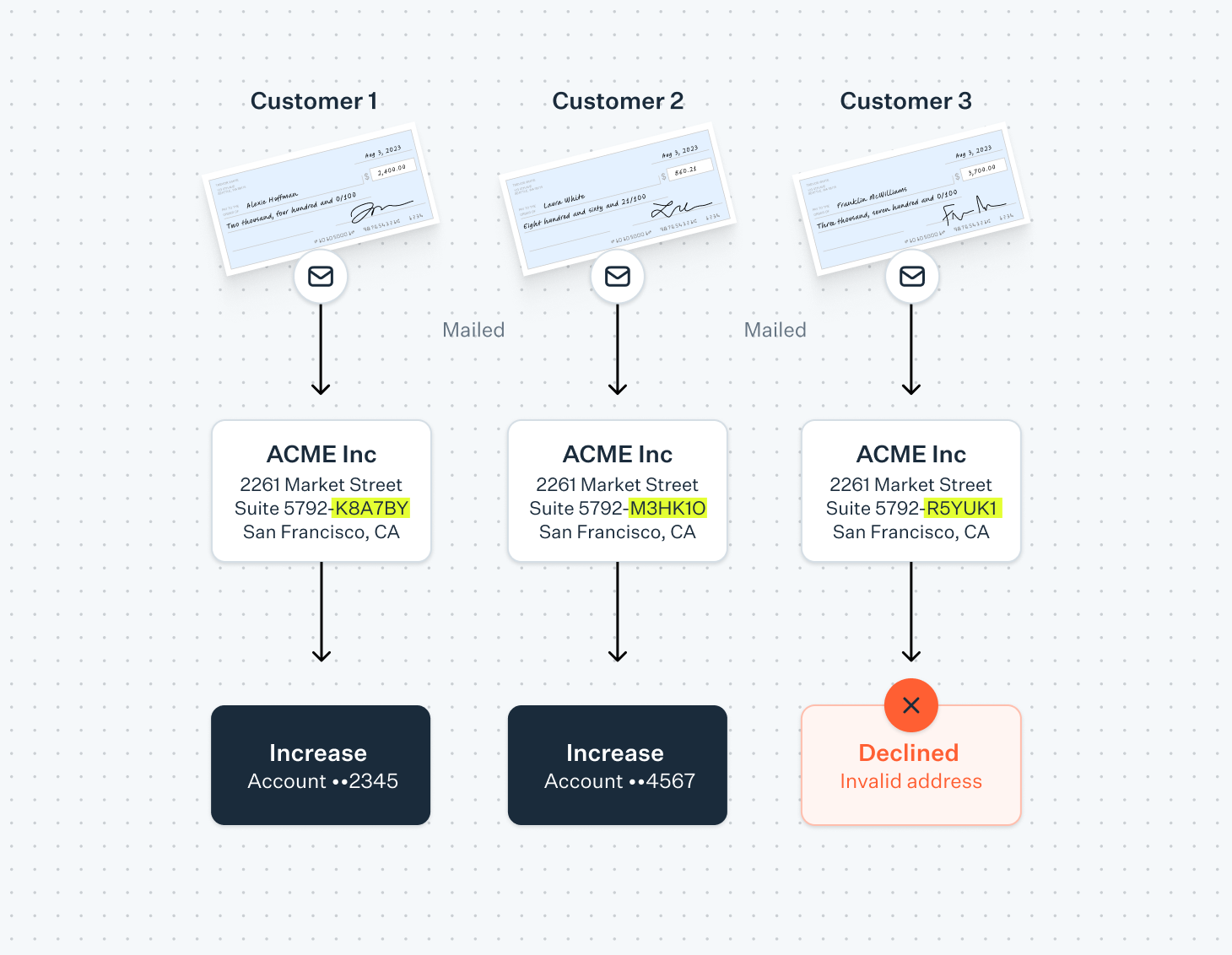

Lockboxes are the latest addition to our suite of check features. You can create unlimited mailing addresses and whenever a check is mailed to that address, we’ll create a Check Deposit and add the funds to your account. We’ll send you a webhook to keep you in the loop and you’ll have full access to accept or decline checks as they come in. We will even shred the checks once they’re processed.

Depending on your business, we recommend making one lockbox per invoice or one lockbox per customer relationship. This makes reconciliation between incoming funds and their revenue attribution much easier.

However, checks are slow and tedious to manage. They sometimes take weeks (or even months!) to be deposited after making it to the recipients’ mailbox. If you’re sending or depositing checks at scale, managing these slips of paper can be a significant headache. This is why we’ve built a fully digital check processing system.

Increase’s API and Dashboard allow efficient, programmatic access to mail checks, deposit check images, and — starting this month — host a virtual mailbox to accept payments in your designated check lockbox.

Lockboxes are the latest addition to our suite of check features. You can create unlimited mailing addresses and whenever a check is mailed to that address, we’ll create a Check Deposit and add the funds to your account. We’ll send you a webhook to keep you in the loop and you’ll have full access to accept or decline checks as they come in. We will even shred the checks once they’re processed.

Depending on your business, we recommend making one lockbox per invoice or one lockbox per customer relationship. This makes reconciliation between incoming funds and their revenue attribution much easier.

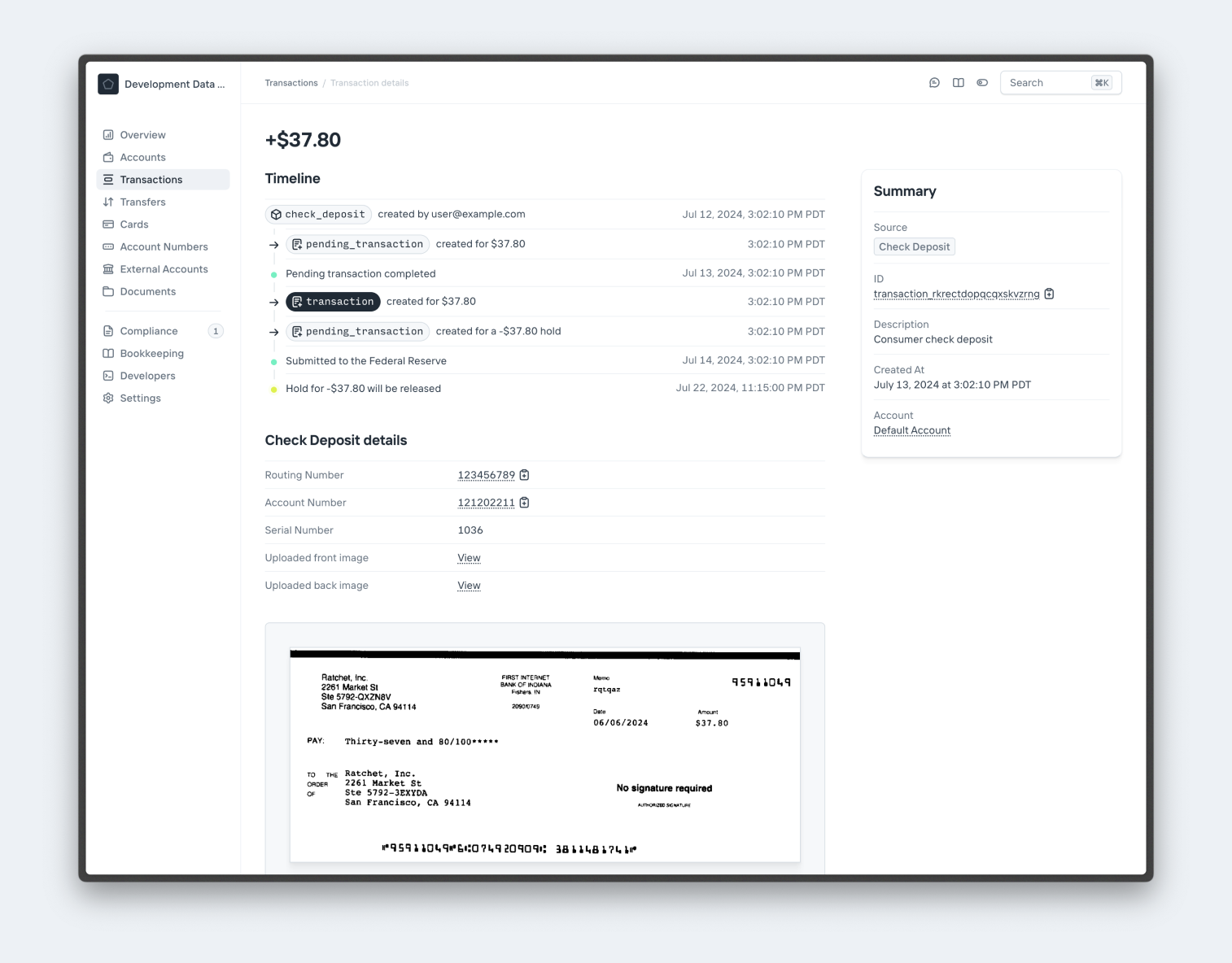

Increase’s commitment to No Abstractions means we give you full control over the network messages sent to Check 21, the Federal Reserve’s network for processing checks. That includes reading the raw TIFF images sent from other banks or controlling fraud by issuing return codes directly to your counterparty’s institution. All of Increase’s features are available in the API for programmatic, bulk actioning and in the Dashboard for one-off debugging as you build your application.

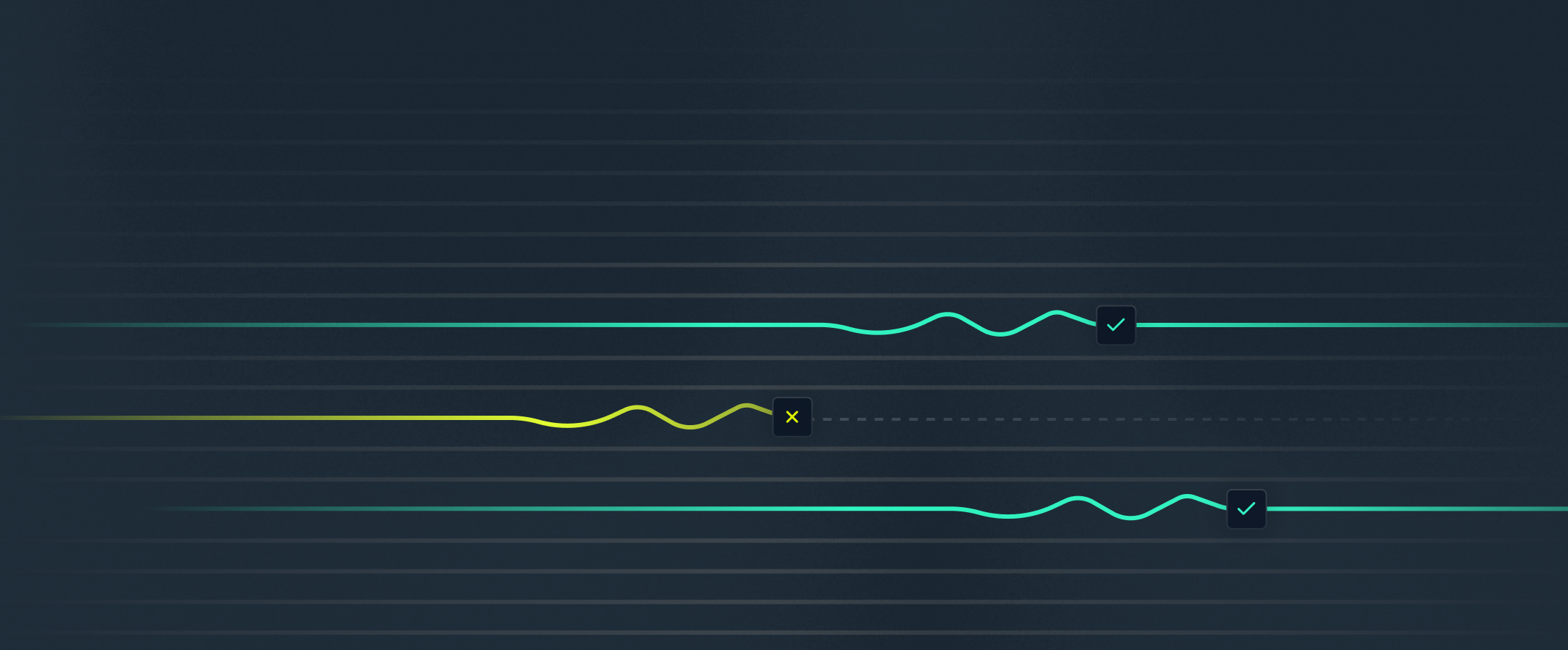

You can also send checks through Increase, either through our check printer under the hood, or by a third party fulfillment provider of your choice. Before the check gets deposited at the recipient bank, we surface critical details to you—including the arrival scan and depositing bank name—allowing you to review and decline the deposit attempt if necessary.

Increase’s check features allow our users fine grained control, high levels of visibility, and great fraud-fighting tools. Read more in our API or contact sales.

Increase’s check features allow our users fine grained control, high levels of visibility, and great fraud-fighting tools. Read more in our API or contact sales.

Increase is not a bank. Banking products and services are offered by Grasshopper Bank, N.A., Member FDIC, First Internet Bank of Indiana, Member FDIC, and Core Bank, Member FDIC. Cards Issued by First Internet Bank of Indiana, pursuant to a license from Visa Inc. Deposits are insured by the FDIC up to the maximum allowed by law through Grasshopper Bank, N.A., Member FDIC, First Internet Bank of Indiana, Member FDIC, and Core Bank, Member FDIC. FDIC deposit insurance only covers the failure of the FDIC insured bank.