Customer story

How Ascend facilitates payments and automates insurance AR/AP workflows with Increase

About Ascend

Ascend is a leading finance automation platform in the insurance industry, streamlining the entire payment lifecycle, from collection and accounting to reconciliation and disbursement. By automating these processes, Ascend helps insurance businesses simplify treasury management, eliminate repetitive, time-consuming operational tasks, and provide a better customer experience. The result is greater profitability for its customers which include leading agencies, MGAs, and insurance carriers.

The problem

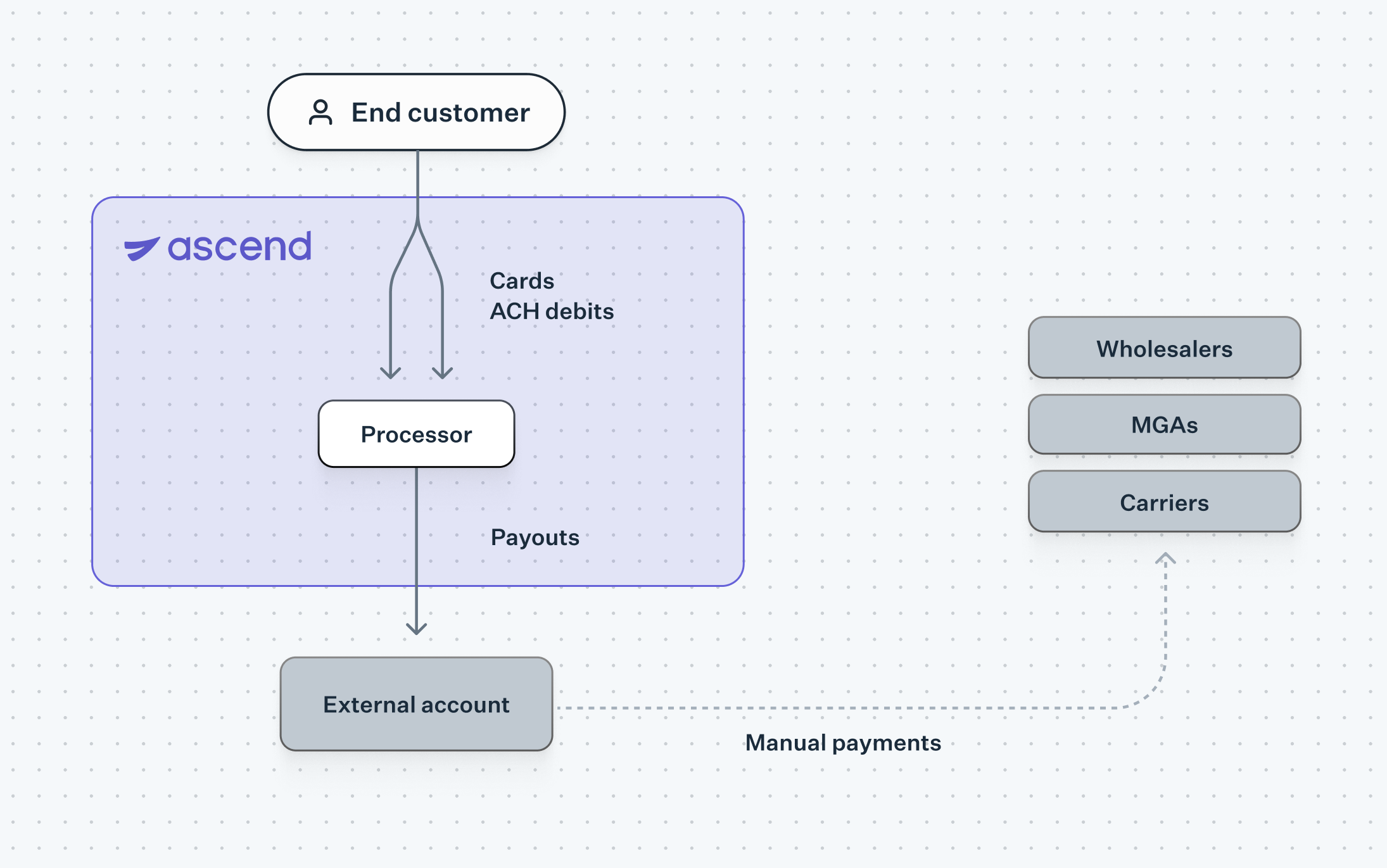

In 2023, Ascend’s platform was already helping insurance agents and brokers collect funds from their clients. However, Ascend saw an opportunity to further automate key payment flows—specifically, disbursing payments from their customers to insurance carriers, MGAs, and wholesalers. This step was essential for improving the overall efficiency of the insurance payment process, which is typically highly manual and often occurs outside of core systems and workflows. To manage these payments on behalf of their customers, Ascend needed a solution that would enable them to create For Benefit Of (FBO) accounts.

Initially, Ascend used a traditional banking solution but quickly ran into several challenges. They were required to ingest ACH files daily, which led to poor visibility and made it difficult to identify errors until the next ACH file arrived. There was no webhook support, making it hard to track events or monitor funds. Additionally, they relied on a large, commingled FBO account to manage funds flows, which added complexity and required additional ledgering.

On the payment acceptance side, Ascend also wanted to offer a wider range of payment methods—such as wires, ACH credits, and physical checks. However, they were limited by the capabilities of their bank.

“We needed a more streamlined, holistic solution to manage the full range of payment flows and gain better control over the process,” said Praveen Chekuri, Co-Founder and Co-CEO at Ascend. “Our existing setup wasn’t cutting it for the scale we needed to achieve.”

On the payment acceptance side, Ascend also wanted to offer a wider range of payment methods—such as wires, ACH credits, and physical checks. However, they were limited by the capabilities of their bank.

“We needed a more streamlined, holistic solution to manage the full range of payment flows and gain better control over the process,” said Praveen Chekuri, Co-Founder and Co-CEO at Ascend. “Our existing setup wasn’t cutting it for the scale we needed to achieve.”

The solution

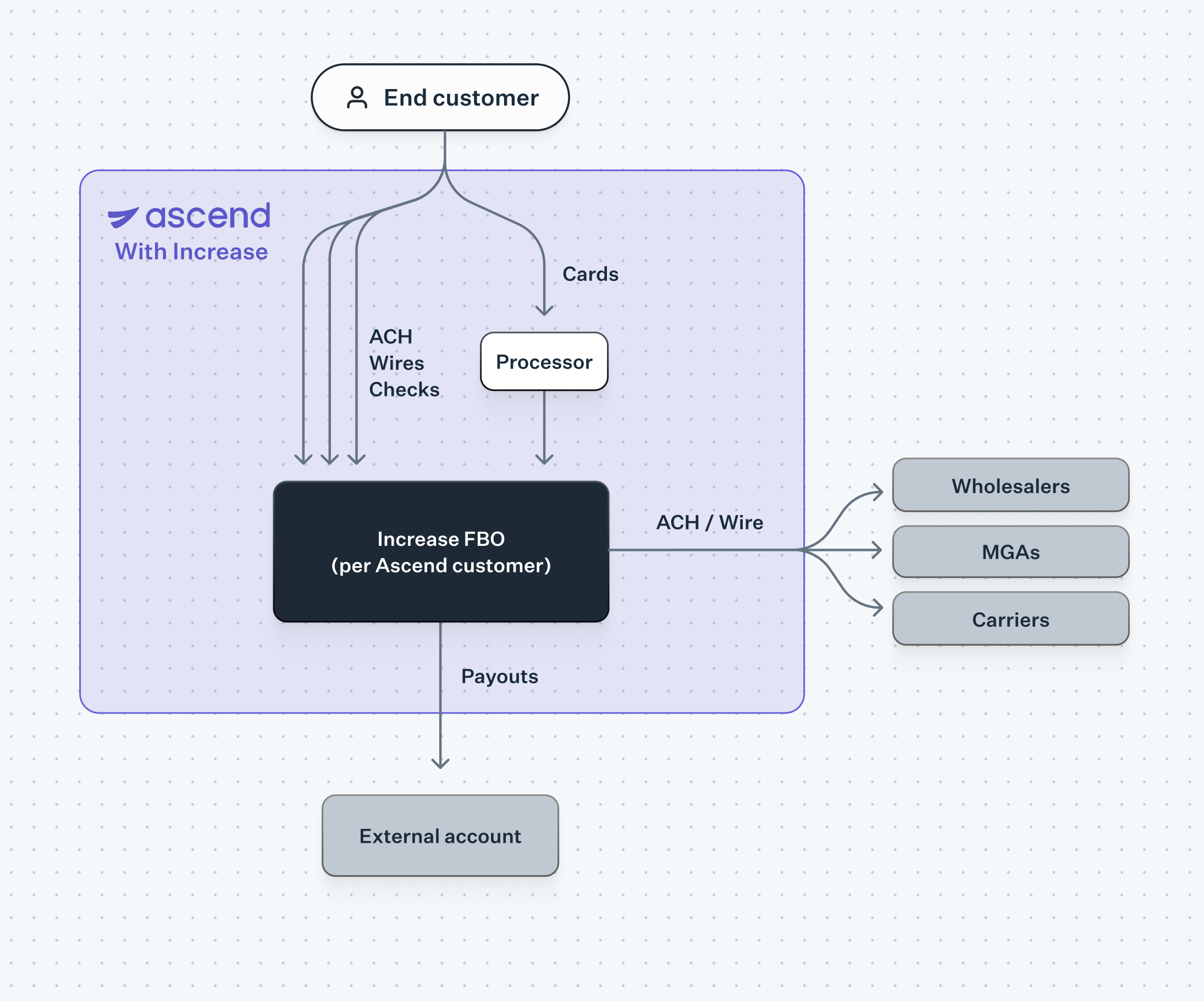

After evaluating various Payfac-as-a-Service and embedded payment providers, Ascend turned to Increase for its comprehensive embedded payments solution. Increase provides direct access to payment rails such as FedACH, Fedwire, and Check21, allowing Ascend to manage payments across multiple channels seamlessly.

The key benefit of Increase was the ability to create unique, fully-functioning accounts for each customer. This allowed Ascend to simplify reconciliation and eliminate the complexity of using a single commingled account. “The ability to create unique accounts for each customer really simplified our entire process,” said Praveen. “With Increase, we could set everything up quickly, scale easily, and maintain a seamless flow of payments to our carriers and wholesalers.”

The key benefit of Increase was the ability to create unique, fully-functioning accounts for each customer. This allowed Ascend to simplify reconciliation and eliminate the complexity of using a single commingled account. “The ability to create unique accounts for each customer really simplified our entire process,” said Praveen. “With Increase, we could set everything up quickly, scale easily, and maintain a seamless flow of payments to our carriers and wholesalers.”

“With Increase, we’ve not only improved the speed and efficiency of our payment processes, but we’ve also expanded our offerings to better serve our customers.”

Unlocking new embedded payment methods

Before implementing Increase, Ascend was limited to accepting card payments and ACH debits through their payments processor. With Increase, they were able to expand their payment acceptance to include ACH credits, wires, and physical check payments directly from end customers.

Increase’s APIs provided access to additional payment rails and unlocked more efficient reconciliation methods. Unique account numbers are created for each end customer, which allows inbound ACH credits and wire payments to be automatically reconciled, streamlining operations even further.

Before implementing Increase, Ascend was limited to accepting card payments and ACH debits through their payments processor. With Increase, they were able to expand their payment acceptance to include ACH credits, wires, and physical check payments directly from end customers.

Increase’s APIs provided access to additional payment rails and unlocked more efficient reconciliation methods. Unique account numbers are created for each end customer, which allows inbound ACH credits and wire payments to be automatically reconciled, streamlining operations even further.

Additionally, Increase’s programmatic lockbox service allowed Ascend to create unique mailing addresses for every customer. This feature enabled Ascend to accept physical checks at scale, automatically processing, reconciling, and securely shredding them—all within a fully automated system. This solution unlocked scalable check processing for Ascend, which wasn’t possible with their previous setup.

“Being able to process checks automatically with Increase’s lockbox service has completely transformed how we handle payments,” said Praveen. “It’s an automated, best-in-class solution that has scaled our check payment capabilities effortlessly.”

Speeding up funds flows

A key advantage Ascend discovered with Increase was the improvement in funds availability. While ACH debits with their current payments processor typically took 3-4 days to settle in an operating account, Increase’s ACH product enabled faster settlement, reducing the time to just one day. This improvement in cash flow management significantly benefited both Ascend and its customers.

“Before Increase, we lacked fine-grained control over ACH, such as remittance information and trace numbers, making reconciliation harder,” said Praveen. “Now, not only is this process much smoother, but we’re also able to cut out a step in the process which means funds are available significantly faster. That’s a huge advantage.”

“Being able to process checks automatically with Increase’s lockbox service has completely transformed how we handle payments,” said Praveen. “It’s an automated, best-in-class solution that has scaled our check payment capabilities effortlessly.”

Speeding up funds flows

A key advantage Ascend discovered with Increase was the improvement in funds availability. While ACH debits with their current payments processor typically took 3-4 days to settle in an operating account, Increase’s ACH product enabled faster settlement, reducing the time to just one day. This improvement in cash flow management significantly benefited both Ascend and its customers.

“Before Increase, we lacked fine-grained control over ACH, such as remittance information and trace numbers, making reconciliation harder,” said Praveen. “Now, not only is this process much smoother, but we’re also able to cut out a step in the process which means funds are available significantly faster. That’s a huge advantage.”

The result

Since working with Increase, Ascend has processed over $1B in annual premiums, demonstrating the scalability and market demand for their platform.

Ascend now serves over 13,000 insurance businesses, representing one in four U.S. insurance companies. This growing market influence underscores the success of Ascend’s embedded payment solution.

“With Increase, we’ve not only improved the speed and efficiency of our payment processes, but we’ve also expanded our offerings to better serve our customers,” said Praveen. “We’re processing more premiums than ever, and our platform is only becoming more scalable and flexible as we grow.”

Ascend now serves over 13,000 insurance businesses, representing one in four U.S. insurance companies. This growing market influence underscores the success of Ascend’s embedded payment solution.

“With Increase, we’ve not only improved the speed and efficiency of our payment processes, but we’ve also expanded our offerings to better serve our customers,” said Praveen. “We’re processing more premiums than ever, and our platform is only becoming more scalable and flexible as we grow.”

Increase is not a bank. Banking products and services are offered by Grasshopper Bank, N.A., Member FDIC, First Internet Bank of Indiana, Member FDIC, and Core Bank, Member FDIC. Cards Issued by First Internet Bank of Indiana, pursuant to a license from Visa Inc. Deposits are insured by the FDIC up to the maximum allowed by law through Grasshopper Bank, N.A., Member FDIC, First Internet Bank of Indiana, Member FDIC, and Core Bank, Member FDIC. FDIC deposit insurance only covers the failure of the FDIC insured bank.